Taxation plan and budget

Taxation service ensures property taxes are properly billed, effectively collected, and that customers receive timely and accurate information on property tax matters.

Our customers

- Property tax account holders

- Business Improvement Areas

- Law firms, property manager, and financial institutions

- The City of Calgary

- The Government of Alberta

Our partners

Our primary partners are The City of Calgary business units including, but not limited to:

- Customer Service & Communications

- Finance

- Law

Value to Calgarians

- addresses the need for reliable revenue via the timely and accurate billing and collection of property taxes. This revenue is used to fund the provision of public services.

- proactive and innovative collection efforts ensure the risk of uncollectible revenue remains low and the use of the Tax Instalment Payment Plan (TIPP) program provides The City with stable and predictable cash flow.

- provides confidence to property tax account holders that they are paying their fair share of taxes.

- The TIPP program provides property tax account holders with a convenient payment option that makes their budgeting easier due to certainty in their monthly property tax expenditures.

What we deliver

- The main outputs of our service are annual property tax billings.

Budget breakdown

Service performance

Expected 2026 performance.

What we've heard

The 2023-2036 One Calgary Service Plans and Budgets Service Value Dimensions Survey noted that 43 per cent of respondents have contacted, accessed, or used the Taxation service. Most cited key elements of our service are reliability, accuracy, fairness and accessibility.

The Perception of the Tax Instalment Payment Plan (TIPP) Program Survey held in the Spring of 2021 indicated that:

- 63 per cent of property owners in Calgary are enrolled in TIPP.

- 80 per cent of program users are very satisfied with TIPP and the remaining 20 per cent are somewhat satisfied.

- 91 per cent of program users say that it makes budgeting easier.

- 82 per cent of program users say that the program is easy to understand.

- 78 per cent of program users are satisfied with the enrolment process overall.

What we're watching

- Our service regularly does environmental scans to identify trends of note. 2023-2026 will see a specific concentration on staying responsive to unexpected requests, making things easier for customers, and on the digital shift across society.

- Moving more to digital platforms and channels should enhance service delivery options, create efficiencies, and align better with customer expectations. Other trends to be tracked will be climate change, equity, diversity, inclusion and belonging.

- Our efforts will continue to contribute to The City of Calgary’s Long Range Financial Plan and we will be monitoring and responding to the following key risks as appropriate:

- Replacement of end-of-life primary property tax system called PTWeb

- Upgrade of older system called City Ownership OnLine (COOL) that interfaces with Alberta Land Titles and allows Taxation to receive feeds of ownership changes

- Development and succession management of key talent

Our initiatives

What we plan to do

We will ensure that Calgarians receive accurate and timely property tax information and provide a significant and reliable property tax revenue stream for The City of Calgary while maintaining strong operational performance and making continuous improvements.

How we're going to get there

- Ensure Calgarians have access to their accurate and timely property tax bills by following billing best practices.

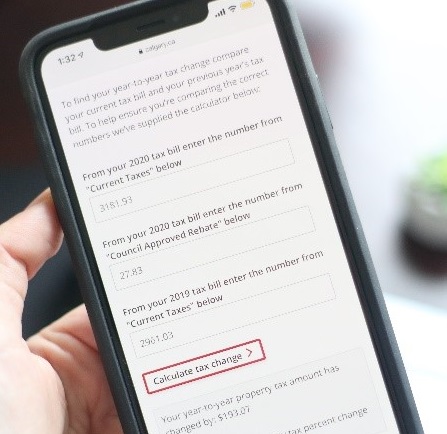

- Improve the customer experience by focusing on improving Calgarian’s understanding and providing more online services and self-service options.

- Provide The City with a significant and stable source of property tax revenue by effectively and efficiently collecting property taxes.

- Help Calgarians in need of financial assistance by offering compassionate property tax relief-based programs under certain circumstances.

- Support Council’s Guiding Principle of Building Strong Communities by improving Business Improvement Area (BIA) engagement and relationship building.