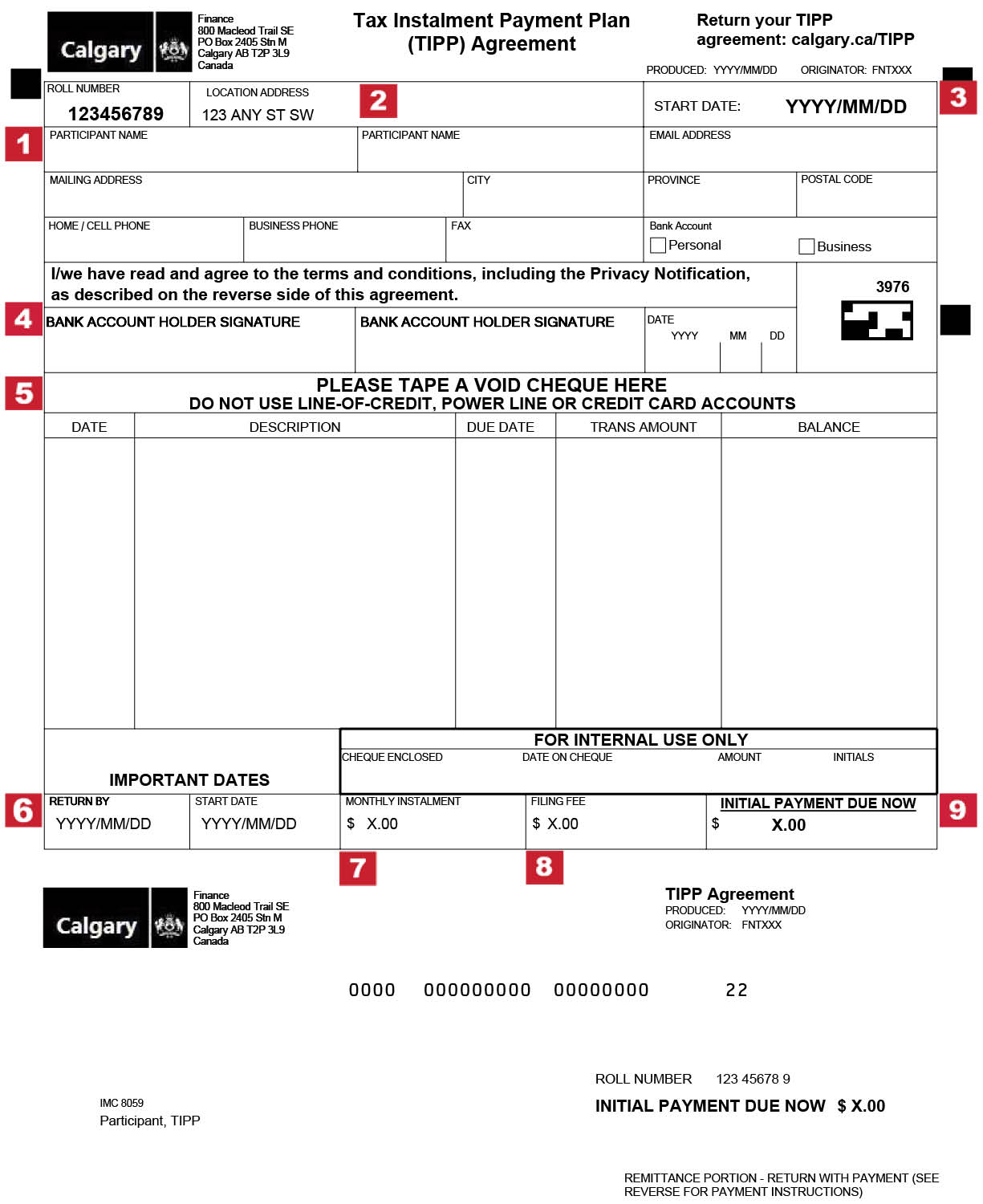

How to fill out your TIPP agreement

Participant Name

Participant Name

Print all the name(s) of those entering into the TIPP agreement. At least one of the TIPP participants must be the bank account holder. For a company joining TIPP: the TIPP participant recorded should be the name of the company AND the name of the signing officer for the company’s bank account.

Location Address

Location Address

The agreement is for this address only. If you own parking stalls, storage units or other properties, you must request and fill out an agreement for each account.

Start Date

Start Date

This is the date the first automatic monthly payment will be withdrawn from the bank account you’ve provided after you have successfully joined TIPP.

Bank Account Holder Signature

Bank Account Holder Signature

The TIPP Agreement should be signed by ALL the TIPP participants who are entering in to the agreement. At least one of the TIPP participants must be the bank account holder. If the monthly payment will come from a company bank account, the signing officer for the bank account signs the agreement on behalf of the company.

NOTE: the signature must be your actual signature, not a digital or typed version of your signature.

Tape a Void Cheque Here

Tape a Void Cheque Here

If you are providing a VOID cheque, tape it in this area. If you will be providing a Pre-authorized Debit (PAD) form instead, leave this space empty.

NOTE: Line of Credit and Credit Card accounts will not be accepted.

Return By (date)

Return By (date)

This is the date the completed and signed TIPP agreement must be received by The City.

Monthly Instalment

Monthly Instalment

This will be your monthly instalment.

Filing Fee

Filing Fee

There is no filing fee to join TIPP.

Initial Payment Due

Initial Payment Due

There is no initial payment required to join TIPP.