Residential property assessments

Assessments to residential properties are completed annually for the purpose of distributing fair and equitable taxation. Most residential properties are assessed using the sales comparison approach to value, based on The City's estimate of the property’s market value as of July 1 of the year prior, and the characteristics and conditions of the property as of December 31.

Each year, we assess all residential properties in the City of Calgary. The combined value of single residential homes and condominium properties is posted on the assessment roll highlights page each year.

Residential property types

-

Single residential

How we assess a single residential property

-

Residential condominiums

How we assess a residential condominium property and their parking and storage units

-

Multi-residential

How we assess a multi-residential property

-

Mobile home

How we assess a mobile home property

Vacant residential land

Location

- There are over 200 established and developing residential communities in Calgary. Each community has different proximities to services and amenities. This helps shape buyers and sellers’ perception of market value.

- Within a community there may be multiple land rates used based on its location. Land in one specific area could be valued higher (or lower) when compared to your property. For example, estates areas within communities often receive a higher land value than non-estates areas.

- The market value for vacant residential land is heavily influenced by location and is often the first criteria examined in a market analysis.

Land Use

- Ranges in land use vary by residential property type, from low density single-family to higher density multi-family residential. Land uses city-wide are interpreted using Land Use Bylaw 1P2007.

- Land use influences how a property may be developed into a higher and better use by regulating criteria such as:

- Size and density of development

- Height and massing of proosed/existing building

- Permitted uses of space within a proposed/existing building

- The market for vacant residential land is influenced, in part, by the land use (or anticipated re-designation of use).

Size and Shape

- Parcels of vacant residential land vary in size from single-family home sites to large amalgamated development lots used for multi-family development.

- The lot configuration, or plottage, may affect the market value of a property, particularly setback requirements, access, frontage and utility right-of-ways.

- The legal parcel size of a property directly affects the market value of a property, all residential assessment values are calculated using a diminishing rate of returns.

Influences

There are several external factors that could impact the market value of a property. Positive influences as examples include, but are not limited to:

- Proximity to green spaces

- “Views” from the property (i.e. mountain views, downtown views, river valley view etc.)

Negative influences as examples include, but are not limited to:

- Traffic noise

- Adjacent or intrusive industrial or commercial uses

Negative influences as examples include, but are not limited to:

- Traffic Noise

- Adjacent or intrusive industrial or commercial uses

Time to Development

Not all vacant parcels of land designated for residential use are equal based on their availability to be developed. All parcels of vacant residential land are reviewed annually to estimate when a property may be developed. Criteria reviewed may include, but is not limited to:

- Servicing availability (Water, Storm, and Sewer capacity)

- Access (roadways leading to the site)

- Growth Management (Public Transit, Emergency Response Services, Local Infrastructure)

Market value

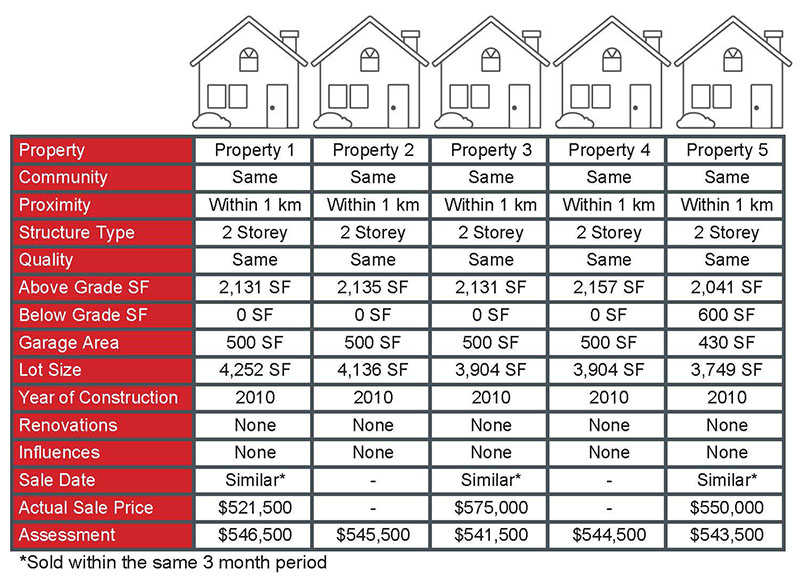

Your property assessment reflects the market value of your property - the amount it would likely have sold for on the open market as of July 1 last year.

Market value is determined in two steps:

- We look at comparable sales to find the typical value based on various factors of the home (i.e. above grade square footage or land size); then

- Apply the typical values to your home's factors to get a likely market value.

The above process is called mass appraisal. It establishes fairness and equity between assessments and property owners and is the legislated method of preparing assessments in Alberta.

Factors that may affect your market value:

- total finished living area above and below grade

- quality and age of structure

- renovation level

- building type (i.e. duplex, etc.)

- structure type (i.e. bungalow, two-storey, etc.)

- unit type in condominiums (i.e. townhouse, apartment, basement unit, end unit, penthouse unit, etc.)

- existence, type and size of garage

- lot size

- views attainable from the property

- property location within the community including:

- proximity to traffic

- green spaces

- community services

- commercial properties

- multi-family properties

- waterways

- schools

- trains

- transmission lines

- communications towers