Property Tax Breakdown

We use your property tax dollars to invest in making Calgary a great place to live.

Get a complete breakdown of how your property tax dollars are used by entering

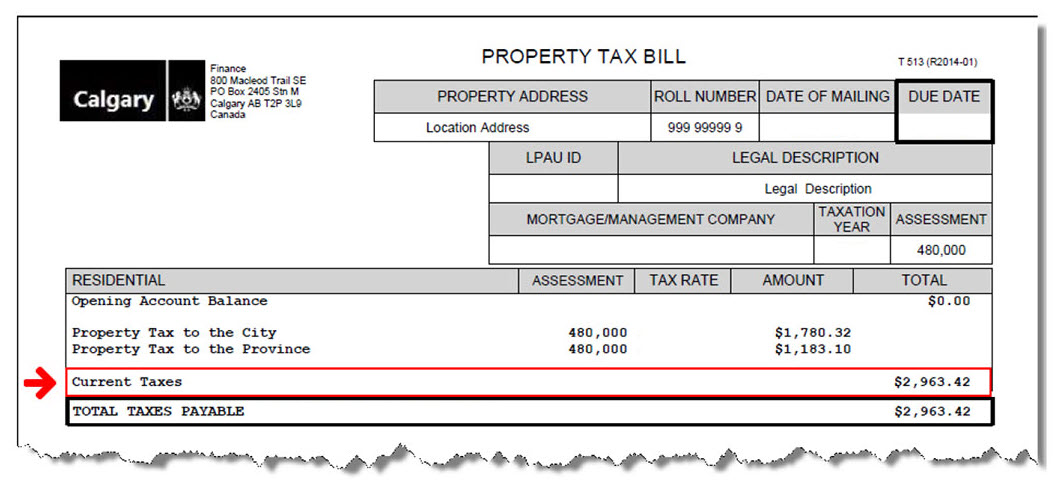

your annual property tax amount in the box below. You can find your annual property tax amount on the property tax bill we mail you in May, shown as the "Current Taxes" line.

Tax Bill Sample

Get an estimate of your next property tax bill.

Use your property's assessed value, which we mail out each January, to get an estimate of your next property tax bill before May.

| Service name | Percentage (%) | Tax amount | Breakdown |

|---|---|---|---|

|

Government of Alberta

|

35.19% | $0.00 0 dollars and |

| Public Safety and Bylaws | 20.60% | $0.00 0 dollars and | |

|---|---|---|---|

|

Police Services

|

12.15% | $0.00 0 dollars and | |

|

Fire & Emergency Response

|

6.74% | $0.00 0 dollars and | |

|

Calgary 9-1-1

|

0.92% | $0.00 0 dollars and | |

|

Bylaw Education and Compliance

|

0.32% | $0.00 0 dollars and | |

|

Fire Inspection & Enforcement

|

0.20% | $0.00 0 dollars and | |

|

Pet Ownership & Licensing

|

0.10% | $0.00 0 dollars and | |

|

Emergency Management & Business Continuity

|

0.13% | $0.00 0 dollars and | |

|

Fire Safety Education

|

0.03% | $0.00 0 dollars and | |

| Transportation | 14.71% | $0.00 0 dollars and | |

|

Public Transit

|

8.04% | $0.00 0 dollars and | |

| Streets

|

4.15% | $0.00 0 dollars and | |

|

Sidewalks & Pathways

|

1.37% | $0.00 0 dollars and | |

|

Specialized Transit

|

1.15% | $0.00 0 dollars and | |

|

Taxi, Limousine & Vehicles-for-Hire

|

0.00% | $0.00 0 dollars and | |

| Parking

|

0.00% | $0.00 0 dollars and | |

| Enabling Services | 8.79% | $0.00 0 dollars and | |

|

IT Solutions and Support

|

1.72% | $0.00 0 dollars and | |

|

Facility Management

|

1.72% | $0.00 0 dollars and | |

|

Human Resources Support

|

0.86% | $0.00 0 dollars and | |

|

Financial Support

|

0.78% | $0.00 0 dollars and | |

|

Corporate Governance

|

0.35% | $0.00 0 dollars and | |

|

Mayor and Council

|

0.33% | $0.00 0 dollars and | |

|

Executive Leadership

|

0.45% | $0.00 0 dollars and | |

|

Infrastructure Support

|

0.15% | $0.00 0 dollars and | |

|

Corporate Security

|

0.74% | $0.00 0 dollars and | |

|

Legal Counsel and Advocacy

|

0.31% | $0.00 0 dollars and | |

|

Data Analytics and Information Access

|

0.36% | $0.00 0 dollars and | |

|

Organizational Health, Safety & Wellness

|

0.42% | $0.00 0 dollars and | |

|

Procurement and Warehousing

|

0.29% | $0.00 0 dollars and | |

|

Council and Committee Support

|

0.10% | $0.00 0 dollars and | |

|

City Auditor's Office

|

0.09% | $0.00 0 dollars and | |

|

Municipal Elections

|

0.04% | $0.00 0 dollars and | |

|

Insurance and Claims

|

0.03% | $0.00 0 dollars and | |

|

Fleet Management

|

0.00% | $0.00 0 dollars and | |

| Contribution to Capital Investments | 8.28% | $0.00 0 dollars and | |

|

Pay-As-You-Go (PAYG)

|

2.88% | $0.00 0 dollars and | |

|

Lifecycle Maintenance and Upgrade Reserve (LMUR)

|

1.74% | $0.00 0 dollars and | |

|

Green Line

|

1.88% | $0.00 0 dollars and | |

|

Community Investment Reserve (CIR)

|

1.04% | $0.00 0 dollars and | |

|

Debt Servicing Reserve

|

0.74% | $0.00 0 dollars and | |

| Parks, Recreation and Culture | 5.14% | $0.00 0 dollars and | |

|

Parks & Open Spaces

|

1.94% | $0.00 0 dollars and | |

|

Library Services

|

1.42% | $0.00 0 dollars and | |

|

Recreation Opportunities

|

0.96% | $0.00 0 dollars and | |

|

Arts & Culture

|

0.78% | $0.00 0 dollars and | |

|

City Cemeteries

|

0.03% | $0.00 0 dollars and | |

| Social Programs and Services | 2.54% | $0.00 0 dollars and | |

|

Social Programs

|

0.25% | $0.00 0 dollars and | |

|

Affordable Housing

|

1.10% | $0.00 0 dollars and | |

|

Neighbourhood Support

|

0.14% | $0.00 0 dollars and | |

|

Community Strategies

|

1.05% | $0.00 0 dollars and | |

| Building, Planning and Business | 2.29% | $0.00 0 dollars and | |

|

City Planning and Policy

|

0.90% | $0.00 0 dollars and | |

|

Economic Development & Tourism

|

1.20% | $0.00 0 dollars and | |

|

Appeals and Tribunals

|

0.10% | $0.00 0 dollars and | |

|

Building Safety

|

0.00% | $0.00 0 dollars and | |

|

Real Estate

|

0.08% | $0.00 0 dollars and | |

|

Land Development & Sales

|

0.02% | $0.00 0 dollars and | |

|

Business Licensing

|

0.00% | $0.00 0 dollars and | |

|

Development Approvals

|

0.00% | $0.00 0 dollars and | |

| Utilities & Environment | 0.93% | $0.00 0 dollars and | |

|

Waste & Recycling

|

0.20% | $0.00 0 dollars and | |

|

Urban Forestry

|

0.42% | $0.00 0 dollars and | |

|

Climate and Environmental Management

|

0.31% | $0.00 0 dollars and | |

|

Stormwater Management

|

0.00% | $0.00 0 dollars and | |

|

Wastewater Collection & Treatment

|

0.00% | $0.00 0 dollars and | |

|

Water Treatment & Supply

|

0.00% | $0.00 0 dollars and | |

| Information and Communication | 0.81% | $0.00 0 dollars and | |

|

Citizen Information & Services

|

0.34% | $0.00 0 dollars and | |

|

Strategic Marketing and Communications

|

0.26% | $0.00 0 dollars and | |

|

Citizen Engagement & Insights

|

0.10% | $0.00 0 dollars and | |

|

Records Management, Access & Privacy

|

0.11% | $0.00 0 dollars and | |

| Tax and property assessment | 0.71% | $0.00 0 dollars and | |

|

Property Assessment

|

0.57% | $0.00 0 dollars and | |

| Taxation

|

0.15% | $0.00 0 dollars and |

Legend

The tax breakdown is not an official tax bill. Calculations are approximate. For a copy of your property tax bill, see Property tax: document request.

Learn more

Working hard to ensure Calgarians receive outstanding value for their property tax dollars. Learn how it all comes together.

Our plans and budgets were created to care for our community. Learn more about our 2023-2026 service plans and budgets.