How TIPP payments are calculated

With TIPP you pay the same amount as your annual property tax bill. Instead of paying one large lump sum payment in June, automatic payments are withdrawn the first day of every month.

- If you join before January 1: Your payments are spread over 12 months.

- If you join after January 1: Your payments are spread over the remaining months of the year. The following year, they will be spread over 12 months.

Changes in instalment amount

TIPP instalments are recalculated twice a year. This ensures you pay the same amount as your annual tax bill, no more, no less.

January to June

January to June

Since tax rates aren’t finalized until spring, we calculate your January 1 to June 1 monthly instalment using:

- The total amount of property tax you paid the previous year

- November budget decisions

- If your tax account has any adjustments, they will be factored into the above formula.

- If you’re an existing TIPP participant, we'll notify you of any payment changes by November, with the first payment starting on January 1.

- You’ll pay the same amount each month from January to June.

The change percentage between your December and January instalment amount is not equal to your year-to-year tax bill change percentage. It’s the change required to spread your monthly payment amounts more evenly over the year.

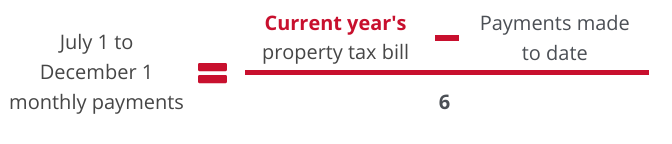

July to December

July to December

With tax rates finalized in the spring, your monthly TIPP payments will be adjusted for the second half of the year.

To calculate your July to December instalments, we consider:

- your current year's tax bill

- payments made to date

The change percentage between your June and July instalment amount is not equal to your year-to-year property tax bill change percentage. It’s the change required to ensure you pay no more or less than your annual tax bill.

Other reasons your monthly payment may change:

-

Supplementary property tax bill

If a new building or addition is completed during the year, you may receive a supplementary tax bill.

Your TIPP payments will be recalculated, and you'll be notified of any changes.

-

Amended property tax bill

If there’s an adjustment to your property assessment or a correction to your original bill, you may receive an amended property tax bill.

Your TIPP payments will be recalculated, and you’ll be notified of any changes.

Annual property tax bill

Your annual property tax bill will be mailed to you at the end of May. As a TIPP participant, your property tax bill is not a request for payment. However, it will show the:

- Credit resulting from instalments made January 1 to May 1

- June 1 instalment amount

- New instalment amount beginning July 1