Determining your fair share of City services

Assessments are based on the fair market value of your property last July 1. Real estate data on all properties sold in Calgary in the previous three years are analyzed. Your individual assessment comes from the analysis of sold properties in your neighbourhood that are very similar to yours.

Assessment includes things like the size of your house, any renovations, the year it was built, the neighbourhood you live in and other variables. All together, they make up the fair market value assessment of your home.

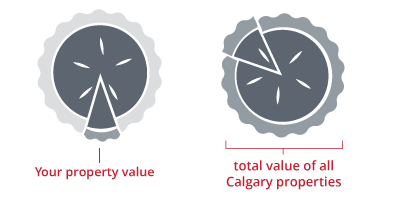

How does your assessment relate to your property tax?

To provide City services, City Council determines what it needs in revenue each year.

Tax rate = City budgetary needs ÷ Total assessed value of all Calgary properties

Your municipal property tax is calculated by multiplying your yearly assessment by the Council approved tax rate.

Your share of property taxes = Tax rate x Your assessment value

Your property tax may change from year to year if:

- Your assessed value increases / decreases greater than the overall assessment base.

- Additional revenue is required to provide services.

Examples

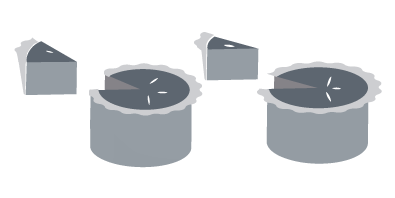

The following examples help explain why your property taxes can change from year to year.

Assessed value stays the same

If your portion of the “pie” stays the same from one year to the next (even if your portion gets bigger and the entire pie gets bigger), and if Council does not require additional revenue, your property taxes will stay about the same because your portion increased by the same amount relative to the change in the entire base (revenue neutral).

Assessed value increases

If however, your portion of the pie increases in size relative to the total pie, even if Council does not require additional revenue, your property taxes will increase because your portion increased disproportionately relative to the change in the rest of the base (revenue neutral).

Additional revenue needed, assessed value stays the same

If Council determines additional revenue is required to fund City services, even if the assessed value of your property, relative to the total change in the assessed value of all Calgary properties, stays the same, you will see an increase in your taxes in the amount of the tax increase approved by Council.

Assessed value and revenue need increases

If the value of your property increased relative to the total change in the assessment base AND Council requires more revenue to fund City services, you will see a larger increase in your property taxes.

Assessed value decreases

If your portion of the pie decreases relative to the change in the entire pie, your taxes will reflect this decrease.

Looking for more information on The City's finances? Visit our financial overview for the big picture.