Tax bills in the Rivers District

Community Revitalization Levy (CRL)

Beginning in 2008, The Rivers District area was designated by The City of Calgary for revitalization, with properties within the district being subject to the Community Revitalization Levy (CRL) for a period of 20 years. Enabled by provincial legislation, The City of Calgary began segregating a portion of the property tax revenue generated within the district for the direct investment in infrastructure improvements within this area. In January 2019, City Council and The Province approved a bylaw amendment to extend the CRL from 2028 to 2047.

The CRL does not increase your taxes; it only distributes a portion of your tax to finance the Rivers District development projects.

Property tax bills for properties within the Rivers District are slightly different from other Calgary property tax bills as they show the total assessed value for the property separated into "Baseline Assessment" and "Incremental Assessment" values.

The Baseline Assessment is the assessed value of your property as of 2007 December 31. This value will remain unchanged and is subject to the common annual municipal and provincial property tax rates. These revenues will continue to flow to The City of Calgary and the Province of Alberta each year.

The Incremental Assessment represents any increase in the assessed value of your property above the Baseline Assessment set on 2007 December 31 resulting from normal market value assessment changes. The Incremental Assessment is subject to the Community Revitalization Levy rate and these revenues will fund the infrastructure improvements within the Rivers District.

The bottom line is:

- The total assessed value has not been affected by the CRL.

- The total property taxes levied on your property are not impacted by the creation of the Rivers District.

- Only the distribution of property taxes has changed.

- The taxes collected from the CRL funds improvements in the Rivers District.

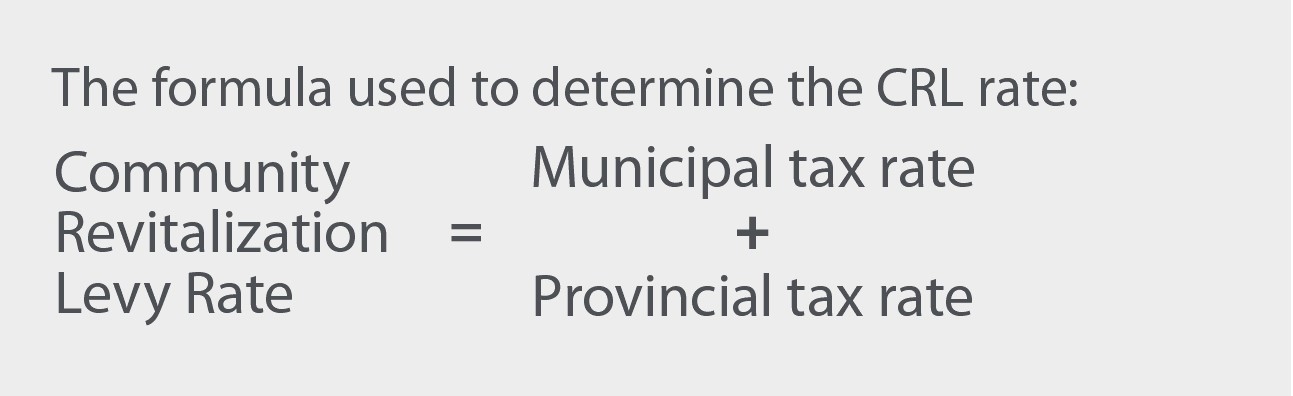

The Community Revitalization Levy (CRL) Rate is approved by City Council and is equal to the Municipal Tax Rate plus the Provincial Tax Rate.

Visit Tax bill and tax rate calculation for more information how these tax rates are determined.

Calculating a Rivers District tax bill

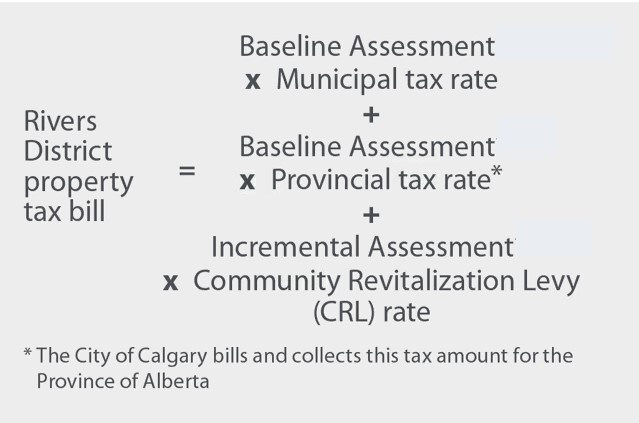

Your property tax is calculated by multiplying the Baseline Assessment of your property by the applicable current municipal and provincial tax rate(s), and then adding the Incremental Assessment value multiplied by the Community Revitalization Levy (CRL) rate.

The City bills and collects the provincial amount for the Province of Alberta, while the CRL tax is collected to fund improvements in your community.

Visit CalgaryMLC.ca for more information about the Rivers District Revitalization Plan.

Bylaw

Rivers District levy rate: 2023 Community Revitalization Levy 14M2023

CRL and the Calgary Municipal Land Corporation (CMLC)

Calgary Municipal Land Corporation (CMLC) is a wholly owned subsidiary of the City of Calgary responsible for the implementation and execution of the Rivers District Community Revitalization Plan, which includes the East Village. CMLC is funded through the Community Revitalization Levy (CRL). The CRL provides the means to segregate increased property tax revenues resulting from the redevelopment in the Rivers District into a fund used to pay for the new infrastructure.

If you have any questions or concerns regarding the CRL, please contact Calgary Municipal Land Corporation at 403-718-0300, or visit their website Calgary Municipal Land Corporation.