Open a waste & recycling business

Before you apply

Do you need to register your business?

We encourage all businesses operating in Calgary to register their business with The City of Calgary.

All businesses operating from a location in Calgary are required to obtain location approval for their business, even if a licence is not required. Location approval helps ensure that the space you are operating has been approved for your business and is safe for all occupants.

If your business requires a business licence, registration will occur at the same time as applying for your licence. If you wish to register your business with the City of Calgary, please apply online.

Do you need a business licence?

Waste & recycling businesses that do require a licence:

- Container depots

- Recycle depots for paper, plastic, glass or rubber

- Scrap metal and salvage yards

- Junkyards

- Resale of used goods

- Salvage collectors

- Used auto part sales

- Catalytic converter sales

- Construction material recyling

Waste & recycling businesses that do not require a licence:

- Waste/recycling hauling businesses not involved in storing, sorting, dismantling, processing or selling material

- Drop-off points for recycling if no transactions take place

- Landfills

-

Find out more about what the City is doing to deter theft and better regulate businesses and individuals in possession of unattached catalytic convertors.

If you don’t know if your business requires a business licence, contact the Planning Services Centre for assistance.

What are your business activities?

Your business activities will determine what's required to open your business:

- if you need a business licence

- what licence types you need

- what permits you may need

Examples of different licence types you may need:

| Example | Licence types |

|---|---|

| Your business will buy or sell used auto parts |

You will need a Salvage Collector licence

|

| Your business will buy or sell catalytic converters |

You will need a Salvage Collector licence |

| Your business operates as a beverage container depot |

You may need a Container depot licence |

| Your business sells used vehicles |

You will need a Motor Vehicle Dealer (Premises or No Premises) licence |

|

Your business receives, processes, stores or dismantles:

|

You will need a Salvage Yard licence

|

|

Your business acquires:

|

You will need a Salvage Collector licence. |

These licence types will be generated as part of your application when you apply. You do not need to apply for them separately.

If your business fits into more than one licence type, you do not need to get multiple approvals. For example, you only need one Fire inspection even if it is required by all of your different licence types.

Operating rules

Container depots

If a business operates as a beverage container depot within 300 metres of a residential area must not:

- have any outside storage,

- conduct business operations on the premise between 9 p.m. and 7 a.m.

- compact materials occurring outside of the building

Any material outside of a building must be fully screened. The business must also demonstrate how impacts such as debris, grocery carts, litter or recyclable material will be managed.

Home-based salvage collection

A salvage collector may be permitted to operate as a home-based business, provided they do not store any of the salvage collected on the residential premises.

Electronic recyclers

- Businesses that operate an electronic drop-off point for used electronic products, including computer equipment, televisions, and laptops, where there are no business transactions are not required to obtain a business licence.

- Businesses that process or dismantle electronics require a salvage yard licence type.

- Businesses that sell or purchase electronic devices, a secondhand dealer licence type is required.

Catalytic convertors and auto parts

Businesses that sell catalytic convertors or auto parts will be required to obtain a Salvage Collector licence.

Do

Businesses must keep a record of:

- the vehicle identification number (VIN), make, model and year of the vehicle that the catalytic convertor originated

- The seller’s first, middle and surnames, current address, telephone number, height, weight, hair colour and eye colour and two pieces of ID

- The full name of the employee who accepted the property

- The date and time of day the property was acquired

Don't

Businesses must not:

- accept damaged catalytic convertors

- remove or deface markings or etchings on catalytic convertors

- accept a catalytic converter where the required information is not provided

In addition:

- Salvage collectors are only allowed to store material on land that has been licensed for a Salvage Yard/Auto Wrecker or Container Depot.

- Failure to comply will result in fines outlined in schedule C of the Business Licence Bylaw.

Business licence fees

Business licence fees are outlined in the business licence fee schedule, which is organized by licence type. If your business requires multiple licence types, the highest category fee will apply.

Fees vary based on the type of licence and whether your business is home-based or commercial-based. All business licence fees are non-refundable and non-transferable and may be subject to change in the next calendar year.

Please note: These fees do not include costs related to land use approvals, required permits, or any third-party approvals or inspections that may be necessary to obtain your licence.

This licence type requires police security clearance recommendation.

Effective January 1, 2025, business licence applicants will now be responsible for obtaining and submitting their police security clearance independently through the Calgary Police Services (CPS) online system or through their local police authority within their jurisdiction, if they are not a resident of the City of Calgary. The City of Calgary will no longer facilitate police security clearance on behalf of applicants.

Previously completed police security clearance obtained within 60 days of application will be accepted.

Non-resident surcharge for businesses based out of town

If your business is based outside of the City of Calgary limits, but you will be conducting business within the City of Calgary, your business is considered ‘non-resident’. Non-resident businesses are required to pay an additional non-resident surcharge on top of standard licensing fees.

If you own commercial or residential property within Calgary, the non-resident surcharge may be waived. Contact the Planning Services Centre for more information.

How do you pay for your licence?

You need to pay for your licence when you submit your application. If you are applying online, you can pay using apply.calgary.ca.

What permits do you need?

Understanding what approvals will be required will help ensure you will be able to open your business with ease and on time. Your business may require Planning Approval or Building Safety Approval, or both in order to be approved to operate from your selected location.

These approvals are based on:

- the location of the business,

- the proposed business activities

- how the space was used before your business.

To learn more about what permits you may need, see the location approval section.

How long will it take to process your application?

To avoid delays, ensure your application includes all the required documents, plans and information.

TIP

Do not sign your lease agreements until you have checked your location approval. We recommend applying for your location approval and building safety approvals before applying for your licence.

Commercial based location timelines

If you require a Tenancy Change

If you require a Building Permit

If you require a Development Permit and a Building Permit

Home based location timelines

Based out of town timelines

What is the name of your business?

A business name, or trade name, is used to represent your business to the public. You may wish to register your trade name with the province. Read more in Opening a business in Calgary: Register your Trade Name.

Who will own the business?

- Sole proprietor – one person owns the business

- Partnership – agreement between two or more people or companies

- Corporation – a legal entity that is separate from its owners, the shareholders

Where is your business located?

All businesses need to provide a location that is approved for their specific business activities. Review the location approval section to make sure your business activities are allowed at your chosen location.

If you’re running your business from more than one location, you need a separate business licence for each location. Each location may require a different combination of permits to satisfy your location approval requirement.

| Example | Type of use |

|---|---|

| Your business operates as a beverage container depot |

Your business is a Recyclable Material Drop-Off Depot |

| Your business sells used vehicles |

Your business is either Vehicle Sales – Major (more than 5 vehicles) or Vehicle Sales – Minor (5 vehicles or less) |

|

Your business receives, processes, stores or dismantles:

|

Your business is a Salvage Yard |

Location approval

-

Your business will be operating from an owned or leased commercial or industrial space in Calgary.

-

Your business will be operating from your home in Calgary.

-

Your business will be operating outside of The City of Calgary.

Commercial based location

Your business will be run from a commercial or industrial location in Calgary.

Planning and Building Safety approvals

What is planning approval?

Part of your location approval confirms that your business is allowed to operate from your chosen location. The Land Use Bylaw specifies a list of allowable uses for each land use district based on what the intent is for that location, which will be listed as either permitted or discretionary. If the use is not listed in a land use district, the business will not be allowed to operate from that location.

Permitted or Discretionary? What’s the difference?

In the Land Use Bylaw, ”uses” are defined as either being Permitted or Discretionary in a Land Use District. Below are definitions for each term.

Permitted means that, if a “use” meets all the rules of the bylaw, it must be approved. The uses listed as permitted were intended for this location and have little to no impact on the surrounding community.

Permitted with Relaxation means a “use” that is permitted but requires a relaxation of one of more bylaw rules. Evaluations are done on a case-by-case basis to determine if the relaxation is appropriate and how it impacts the surrounding community.

Discretionaryuse means that the “use” needs to be reviewed and is evaluated against several factors including applicable policies, appropriateness of the location, the compatibility of the “use” with others in the surrounding area, access, parking, servicing, and sound planning principles. Each submission is reviewed on its own merit at the time of application as discretionary “uses” have a higher impact on the surrounding community.

How your business operates will determine what use or uses best fit your business. Types of planning approval include Tenancy Change, Permitted Change of Use, Permitted with Relaxation Change of Use, and Discretionary Change of Use.

What is building safety approval?

Your business will also be reviewed for safe operations. Based on how the commercial building is constructed and the types of tenants it is designed for, a building will have a classification and occupancy based on the National Building Code – Alberta Edition.

Even if you are not planning any construction or changes to the space, the change in business activities may require a building permit application to review the safety of the space and bring it into compliance with the National Building Code – Alberta Edition. If required, you will need to apply for a Building Permit.

TIP

Before you lease a space, it’s important to determine if the use or uses are listed at a proposed business location, if a use isn’t listed in a land use district, it’s not allowed in that district.

If a use is not listed, you could apply for a Land Use Redesignation, or look for another location for your business.

Look up your land use district on the listed use matrix to determine if your proposed business activities are listed in your district.

How will you occupy the space?

Once you’ve confirmed your business activities are a listed use in a Land Use District, you need to determine how you will be occupying the space, to see which permits you might need to satisfy your Location Approval.

Contact the Planning Services Centre if you are not sure what approvals your business will require from your chosen location.

-

There was a different business using this space and now your business will be taking over, OR you are a new tenant, but you will be sharing the space with an existing tenant

-

You are the first tenant going into a unit in a new building.

-

You are an existing tenant. You have pre-existing approval for this space, but are making changes to operations

You are taking over a previously occupied space

There was a different business using this space and now your business will be taking over, OR you are a new tenant, but you will be sharing the space with an existing tenant.

You will need one or more of the following:

- Tenancy Change: how the space is used is not changing, but the tenant is changing or taking over the existing business with no changes. For example: Retail to Retail. No construction is being done.

- New: A Tenancy Change may also be required if only the use of the space is changing and that use is listed as a permitted in the following districts: C-N1, C-N2, C-C1, C-C2, C-COR1, C-COR2, C-COR3, C-O, C-R1, C-R2, C-R3, CC-MHX, CC-X, CC-COR, CR20-C20/R20, CC-ET, CC-EIR, CC-EMU, CC-EPR, CC-ERR, CC-ER, MU-1 and MU-2, I-B, I-C or I-G. If there are other changes to the space, a development permit may still be required.

- New: A Tenancy Change may also be required if only the use of the space is changing and that use is listed as a permitted in the following districts: C-N1, C-N2, C-C1, C-C2, C-COR1, C-COR2, C-COR3, C-O, C-R1, C-R2, C-R3, CC-MHX, CC-X, CC-COR, CR20-C20/R20, CC-ET, CC-EIR, CC-EMU, CC-EPR, CC-ERR, CC-ER, MU-1 and MU-2, I-B, I-C or I-G. If there are other changes to the space, a development permit may still be required.

- Development Permit: use of the space is changing, for example: Retail to Restaurant. However, you may only need a Tenancy Change if how you will be using the space is listed as permitted in one of the following districts: C-N1, C-N2, C-C1, C-C2, C-COR1, C-COR2, C-COR3, C-O, C-R1, C-R2, C-R3, CC-MHX, CC-X, CC-COR, CR20-C20/R20, CC-ET, CC-EIR, CC-EMU, CC-EPR, CC-ERR, CC-ER, MU-1 and MU-2, I-B, I-C or I-G districts.

- Building Permit: you will be doing construction, or the space needs to be reviewed for safety and be brought into compliance with the National Building Code – Alberta Edition.

- Trade Permits: may be required if plumbing, electrical or HVAC work is required.

This is a new building, and you will be the first tenant in the space

If you are the first tenant going into a unit in a new building you will need:

- Building Permit: new buildings will have approval for the base building. A building permit is required for the individual tenant fittings needed to complete the space.

Trade Permits: are needed for plumbing, electrical or HVAC work within your individual unit.

You may need:

- Development Permit: new building owners will get approval for the base building and new businesses often require a separate development permit for their business.

You are currently occupying the space and changing your business activities

You are an existing tenant. You have pre-existing approval for this space, but are making changes to operations

You may need one or more of the following:

- Tenancy Change: to confirm if the proposed new business activities will match the existing approvals.

- Development Permit: if you’re changing the way the space is being used, you may need a Development Permit.

- Building Permit: if you will be doing construction, or the changes require a building safety review to confirm compliance with the National Building Code – Alberta Edition.

- Trade Permits: may be required if plumbing, electrical or HVAC work is being done or is required to satisfy Safety Code Requirements.

Contact the Planning Services Centre if you are unsure if the changes in operations will require new approvals.

What different types of permits might be required?

Development Permit

You may need a development permit to operate from your preferred location if your proposed business activities do not match the current approved use. This is called a change of use development permit. You may need a development permit for other reasons, including some exterior and interior changes to the space.

Sometimes, even if your business is listed as permitted, your business activities require a relaxation to the bylaw rules. This is considered permitted with relaxation change of use and takes longer to process than a permitted change of use.

Contact the Planning Services Centre if you are unsure if the changes in operations will require new approvals.

How to apply

You can apply for your Change of Use Development Permit before, at the same time as, or after your business licence (Licence) application. We recommend applying before your Licence.

Checklists

Sample drawings

Review the sample drawings to help prepare your application.

Fees, timelines and expiry

| Permit Type | Fee schedule | Permit fee | Advertising fee | Total | Our Process | Timeline | Expiry |

|---|---|---|---|---|---|---|---|

|

Permitted Change of Use |

$190 |

- |

$190 |

- |

5

business days |

1-3

years to commence depending on the type of development permit and land use

district |

|

|

Permitted with Relaxation or Discretionary Change of Use |

$594 |

$30 |

$624 |

60 days

to decision + 21 days advertisement/appeal period *timelines

are subject to change based on circulation requirements |

10-12

weeks |

1-3 years to commence depending on the type of development permit and land use district |

*Review our Development Permit Process page for more information about the planning approval process.

To avoid delays, make sure your application includes all the required documents, plans and information as indicated on the checklist.

Contact the Planning Services Center to determine the current approved "use" for your proposed address.

Tenancy Change

Contact the Planning Services Centre to determine the current approved ‘use’ for your proposed address.

If your business activities fall under the same ‘use’, typically a Tenancy Change application is required. In some Land Use Districts, a Tenancy Change is required if the use is listed as permitted in the district. These land use districts include: C-N1, C-N2, C-C1, C-C2, C-COR1, C-COR2, C-COR3, C-O, C-R1, C-R2, C-R3, CC-MHX, CC-X, CC-COR, CR20-C20/R20, CC-ET, CC-EIR, CC-EMU, CC-EPR, CC-ERR, CC-ER, MU-1 and MU-2, I-B, I-C or I-G districts. If there are other changes to the space, a development permit may still be required.

Please note, during this review, we may determine a Development Permit and/or a Building Permit is required instead or in addition to the Tenancy Change application.

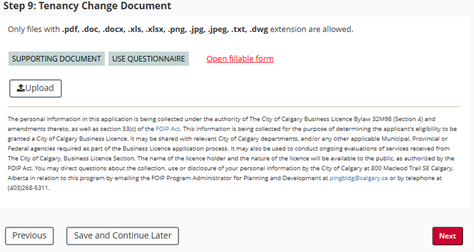

How to apply

If a Tenancy Change application is required, you can apply for it at the same time as a new business licence application or building permit, apply online or in person at the Planning Services Centre.

Step 1

Step 1

Access the website

- Visit apply.calgary.ca

- Select the “Start New Business Licence and/or Land Use Approval” tile. (This launches both new-licence and land-use workflows.)

Step 2

Step 2

Log in or register your Calgary Business Account

- Sign in with your myID, or click “Register New Business Account” to create one.

Step 3

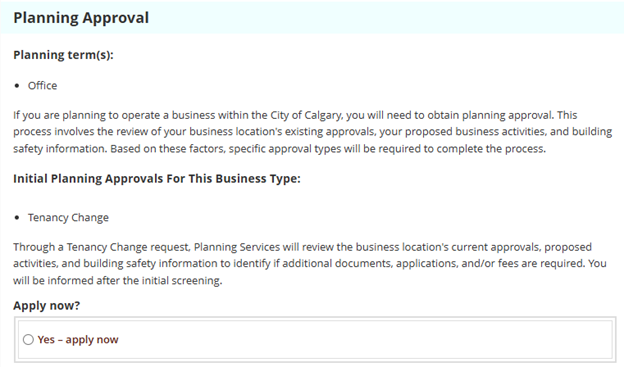

Step 3

Initiate the “Approvals Required” workflow by filling out the application until you reach step 7

On the approvals summary page, click Yes – apply now.

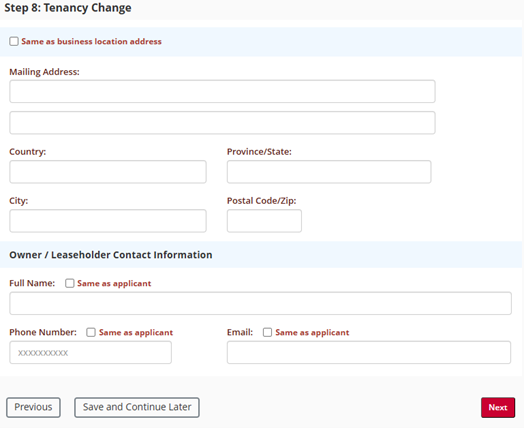

Step 4

Step 4

Enter applicant and business details

- Applicant’s name, contact info and role

- Business legal name, address, operating hours

Step 5

Step 5

Provide a description of the proposed use

- Short narrative of activities and occupancy

Step 6

Step 6

Upload required attachments.

Note: Not all listed document types are required for all applications

- Signed lease or letter of intent

- Site plan (unit location)

- Interior floor plan (if changed)

- Specialist reports (fire safety, accessibility, etc.)

- Use questionnaire

Step 7

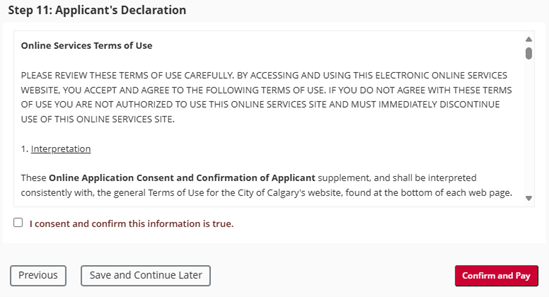

Step 7

Review and accept declarations

- Read the City’s standard applicant declaration

Steps 8 and 9

Steps 8 and 9

Pay all applicable fees

- Portal auto-calculates licence and land-use fees

- Pay by credit card and download your receipt

Submit the application

- Click Submit to send for review

| Permit Type | Fee schedule | Total | Timeline |

|---|---|---|---|

|

Tenancy Change |

Planning applications fee schedule

|

$0 |

Approximately

10 business days |

Building Permit

A building permit will be required if you are making changes to your space, including adding, moving, or removing wall partitions. Even if you are not proposing any construction, you might still need a building permit to confirm that the space meets the required Safety Codes. Upgrades to the space may be necessary to bring it into compliance with the National Building Code - Alberta Edition and all applicable health and safety standards. A building permit confirms that your space is safe to operate your business from.

How to apply

You can apply before, at the same time as, or after your business licence application. You can submit Building permit details and drawings online or in person at the Planning Services Centre.

Checklists

For more information about your business activity and the associated building permit code classification, visit Alberta Building Code for commercial building permits. For more information about when a building permit is typically required, visit Calgary.ca/commercial or contact the Planning Services Centre.

Fees, Timelines and Expiry

| Permit Type | Fee schedule | Permit fee | Total | Timeline | Expiry (from date of issuance) |

|---|---|---|---|---|---|

|

Commercial

building permit |

Varies |

Please use the Building permit fee calculator to estimate your fee. |

Varies based on complexity | 180 days until you require a progress inspection |

Trade Permits

You may require a trade permit if you are doing any upgrades or new in a specific trade. This can include required upgrades to the existing HVAC system in the building, changes or upgrades to plumbing, electrical and gas systems. A trade permit confirms that the work being done complies with the appropriate safety codes.

Commercial Trade Permit applications must be done by the appropriate licensed Trade Contractor. Visit Hiring a Contractor for information on what to look for when choosing a contractor.

Home Based Location

Your business will be run from your home in Calgary. You may have a desk/telephone operation, complete your paperwork at home, or you may have customers coming to your home to be considered a home based business.

If you want to run your business from your home, you will need to decide how your business will operate out of your home.

If you meet the rules of a home occupation class 1, this approval will be automatically granted when you apply for your business licence. It is valid until your business is no longer operating from your home.

If your business does not meet all the home occupation class 1 rules, you will need to apply for a home occupation class 2 development permit. This can be done before, at the same time, or after your business licence application. *

The table below will help you determine if you qualify for a home occupation class 1 or if you will need to make an application for a home occupation class 2. A home occupation class 2 development permit does not guarantee an approval.

-

Opening a Home-Based Business

March 16, 2023Hear from the Development, Business & Building Services team about land use approval, permits, fees, and timelines to get your business approved and open sooner.

| Home occupation class 1 | Home occupation class 2 | |

|---|---|---|

| You live in the home associated with the business: | Yes | Yes |

| The number of business related visits to your home per week: | 0 - 3 max. | 4 - 15 |

| The garage or related structure is used for the business: Note, a small storage area that is not impacting parking may be allowed for either. | No | Yes |

| A large vehicle (over 4,536 kg gross vehicle weight) is parked/stored at or near the home: | No | Yes |

| Employee or business partner working at your home (that does not also live there): | 0 | 1 |

| Your business is food-related, and you are using a kitchen in your home: | No | Yes |

*This table is for convenience only and does not include everything listed in our Land Use Bylaw. Please review the full list of rules located in the Land Use Bylaw section 207 “Home Occupation – Class 1” and section 208 “Home Occupation – Class 2.”

Fees, Timelines & Expiry

| Location approval | Fee schedule | Permit fee | Advertising fee | Total | Timeline | Expiry |

|---|---|---|---|---|---|---|

| Home occupation class 1 | - | - | $0 | 5 business days | No expiry | |

| Home occupation class 2 | $449 | $32 | $481 | Approximately 10-12 weeks | Varies, refer to your permit's conditions of approval for the expiration |

Building permit (if applicable)

While many Motor Vehicle Repair and Service businesses are suitable to take place in residential garages, there are certain types of businesses that involve significant quantities of vehicle exhaust, as well as flammable or combustible liquids and gases. In some cases, special ventilation systems, and other significant upgrades to the garage’s exterior wall construction may be required to comply with the National Building Code (Alberta Edition).

The below table summarizes the most common types of these businesses and what Safety Codes permits are required:

| Business Type | Permit Requirements (if the work is taking place inside the garage) | Rationale |

|---|---|---|

| Window tinting, vehicle detailing, vehicle wraps, wheel balancing/tire swaps, vehicle inspections | Mechanical Permit | Vehicle exhaust needs to be exhausted for health reasons. |

| Oil change, Full service engine repair/swaps, Dent repair, Vehicle painting and body repair | Building Permit and Mechanical Permit |

Vehicle exhaust needs to be exhausted for health reasons. These services could involve storage or use of flammable/combustible liquids and gases; therefore these operations are commercial in scope. A typical residential garage (attached or detached), will likely require noncombustible wall framing and fire resistance rated walls, and fire separations (in the case of an attached garage), which are difficult and expensive alterations to make. |

Note: Electrical, plumbing or gas permits may also be required if the work involves installation of or alterations to electrical, plumbing or gas systems.

Building permit details and drawings can be submitted online or in person at the Planning Services Centre.

Based out of town

Your business is based outside of the City of Calgary. Location approval is not required from the City of Calgary, but it is recommended that you check with the municipality or county in which you will be basing your operations for their requirements.

Your business is based outside of Calgary city limits. Location approval is not required from The City of Calgary, but it is recommended that you check with the municipality or county in which your operations will be based for their requirements.

If your business will be based outside of Calgary city limits, but you will be conducting business within Calgary, your business is considered ‘non-resident’. Non-resident businesses are required to pay an additional non-resident surcharge on top of standard licensing fees.

If you own commercial or residential property within Calgary, the non-resident surcharge may be waived. Contact the Planning Services Centre for more information.

Apply

Prepare your application

Once you know how and where your business will operate, you’re ready to apply.

For a smooth application, make sure you know the following information:

- Business Activities

- Location of Business

- Fee payment at the time of application*

- Ownership

- Name of Business

- Contact information for the business and owner

- If you are applying online, a myID account

- Two pieces of government issued identification

Tips for a smooth application process

Before you apply

Before you apply

- Put together a cost and timeline estimate.

- Confirm the requirements needed to operate from your selected location:

- Is your type of business allowed to operate from your chosen location (is the Use listed in your Land Use District)

- What type of Permits do you need as part of your Location Approval? See location approval.

- Do you need to apply for a development permit or tenancy change as part of your Location Approval?

- Does the space require any upgrades to comply with Building and Fire Codes?

- Are you doing construction yourself or hiring a contractor?

- Do you need to apply for a building permit as part of your Land Use Approval?

- Do you need approval from the property owner before making changes to the space?

- Hire the appropriate contractors for the project.

- Are your contractors licensed

- Can your contractors pull the right trade permits to work on your business?

After you apply

After you apply

- Submit all required documents as soon as you have prepared the permit requirements

- If your Business needs a Development and Building Permit, submit the Development Permit first and wait for a decision prior to submitting your Building Permit

- If your Business needs a Building Permit, submit all necessary Building Permit requirements

- Follow-up on requests for further information

- Book and complete your Inspections if a Building Permit is required

- Book and complete your Health and Fire Inspections once the Building Permit is complete

Need help? A business approvals representative can help you determine what approvals you will need. Contact The Planning Services Centre.

Apply for your licence and required permits

To apply online, you need a myID account. Create a myID account.

Apply in person

Once you have gathered all required documents, you can apply for your permit in person by visiting the Planning Services Centre.

After you apply

What approvals do you need?

After you submit your application online, you will get a confirmation email summarizing your application. It will include your Business Identification number (BID) and your next steps. If you do not get this email, check your junk email folder and then contact the Planning Services Center if you still did not receive it.

Once you apply for your business licence, you must complete your outstanding approvals before the business licence is issued.

The approvals you will need for your licence are:

required

*AMVIC - Alberta Motor Vehicle Industry Council

| Licence categories | Description | Location Approval | Fire | Show ID | Police Check | AMVIC | Provincial |

|---|---|---|---|---|---|---|---|

|

Container depot |

Your business collects and stores:

|

- | - | - | |||

| Salvage collector |

Your business acquires:

|

- | - | - | |||

| Salvage Yard/Auto Wrecker |

Your business receives, processes, stores or dismantles:

|

| Licence Categories | Description | Show ID | Police check | AMVIC |

|---|---|---|---|---|

|

Salvage Collector |

Your business acquires:

|

| Licence Categories | Description | Show ID | Police Check | AMVIC |

|---|---|---|---|---|

|

Salvage Collector |

Your business acquires:

|

|

|

|

How to get your approvals

Location approval

All businesses in Calgary require planning approval before they can open. We recommend that you review and apply for required permits prior to applying for your licence.

Commercial Location Approval

The City of Calgary will need to review your proposed location and determine what approvals are required to operate legally and safely.

All businesses in Calgary require location approval before they can open.

To review what types of Planning approval are required for your business, refer to the location approval section.

Home-based Location Approval

Home based businesses will always need a Home Occupation permit. Some home-based businesses may also require a commercial building permit to operate safely. Read more about what permits you may need in the location approval section.

Based out of town

Your business is based outside of the City of Calgary. Location approval is not required from the City of Calgary, but it is recommended that you check with the municipality or county in which you will be basing your operations for their requirements.

Show ID

You are required to provide two pieces of valid, government issued identification, one of which must contain photo identification (ID). When you apply for your licence online, you will be required to upload your ID.

Acceptable forms of government issued photo identification may include:

- driver’s license

- passport

- permanent resident card

Acceptable forms of government issued identification include:

- provincial health care card

- birth certificate

- marriage certificate

Police Check

Effective January 1, 2025, business licence applicants will now be responsible for obtaining and submitting their police security clearance independently through the Calgary Police Services (CPS) online system or through their local police authority within their jurisdiction, if they are not a resident of the City of Calgary. The City of Calgary will no longer facilitate police security clearance on behalf of applicants.

Previously completed police security clearance obtained within 60 days of application will be accepted.

| Business Licence Approval Type | Timeline |

|---|---|

| Police check | Approximately 2-3 weeks |

Fire

Most businesses that operate from commercial premises require an inspection from the Fire Prevention Bureau before the licence can be issued.

If a business licence is for a low fire-risk licence type, it can be issued if only the Fire approval is outstanding. Low fire-risk businesses need to have the fire inspection within 30 days of their licence being issued.

Before you book your inspection, you must be ready for business, which means:

- Applicants must be in possession of the space/site

- The business is ready to serve customers (e.g. shelves are stocked and fixtures are in place)

| Business Licence Approval Type | Timeline |

|---|---|

| Fire inspection | 5 business days |

To book your inspection contact 311 with your Business Identification (BID) number to request a Fire Inspection for Business Licence (call 403-268-2489 outside of Calgary) .

It can take up to 5 business days for an inspector to visit the space.

See the Fire Department Business Licence Checklist to see what is required for your inspection.

The Fire Prevention Bureau will notify the Licence Division with the results of the inspection.

This inspection must be performed by the Fire Prevention Bureau inspectors. This approval is in addition to any inspection done by the firefighting division, such as the occupancy inspection completed on your building permit.

AMVIC

The Alberta government requires a license for certain motor vehicle business activities. You must contact the Alberta Motor Vehicle Industry Council (AMVIC) for details about obtaining a provincial licence. Visit Home - Alberta Motor Vehicle Industry Council (amvic.org)

AMVIC requires confirmation of City planning approvals before they will issue a provincial AMVIC licence. Once AMVIC issues your provincial licence, you must provide it to The City of Calgary, which will then release your municipal business licence.

Applicants can present the AMVIC license:

- In person:

Planning Services Centre:

3rd floor, 800 Macleod Trail S.E.

Calgary, AB

- By email: licencedivisionteam@calgary.ca

Provincial Licensing

Contact Service Alberta at 1-780-427-4088 (or toll free in Alberta only at 1-877-427-4088) and provide details of the licence types you are currently applying for with The City of Calgary. Service Alberta will direct you to the appropriate provincial contact which will provide further direction in regard to fulfilling the provincial licensing requirements necessary for obtaining your municipal business licence.

Only certain business activities require provincial licensing in addition to your municipal business license. Review the Provincial Licence section to find out if you need this approval.

Provincial licenses must be submitted to The City’s licence division to obtain the municipal license.

You can present your provincial licence by emailing your business licence file manager.

| Business Licence approval type | Timeline |

|---|---|

| Provincial licensing |

Contact Service Alberta for timelines for provincial licensing. |

After you have obtained all your approvals, your Business Licence can be issued to you.

Check the status of your application

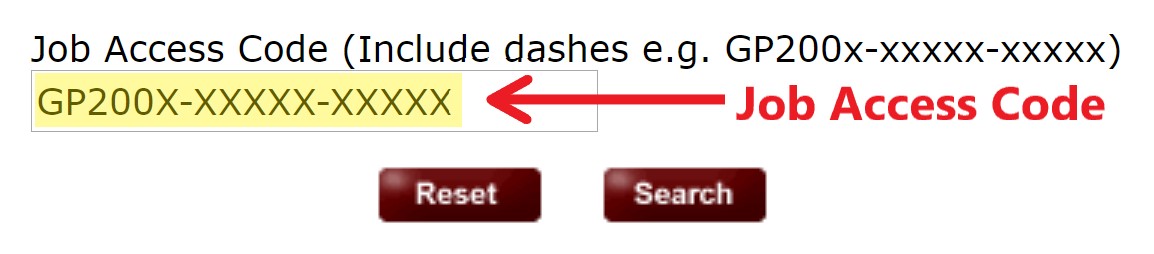

After you submit your application online, you will get a confirmation email with a Job Access Code (JAC).

To track your application and check its status, enter your Job Access Code in Vista.

If you need help or have questions, contact our Planning Services Centre.

Get a copy of your licence

As part of The City’s efforts to accelerate the business license approvals process, customers with a myID business account can receive a digital copy of their business licence via email. This is available to customers applying for a new business licence or renewing an existing licence. To learn more about the benefits of a myID business account and to sign-up today, please visit myID business account.

Lost or damaged licences

If your licence is lost or damaged and you require a new copy, duplicate licences can be requested through apply.calgary.ca/managebusiness or by contacting the Planning Services Centre. Customers with a myID business account can now receive a duplicate copy of their business licence via email.

Licence not received in the mail

If you prefer to receive a mailed copy of your business licence, you can select this option by requesting a duplicate copy online or by calling the Planning Services Centre. Paper duplicates are offered free of charge at this time. Please allow about two weeks to receive your licence in the mail. If you have not received it within this timeframe, please contact the Planning Services Centre.

When does your licence expire?

Business licenses expire one year from the issuance date. You’ll get a notice in the mail 45 days before your licence expires to notify you of the expiry date. To renew your licence, see licence renewals.

Renewing your business licence

Your business licence needs to be renewed every year to remain active. We will mail you an invoice 45 days prior to payment being due. How you choose to pay for your renewal will affect when we receive the fee, so please allow sufficient processing time.

Payment options

Online renewal

To renew your licence online, sign into your myID business account and manage your business at apply.calgary.ca.

If you do not have a myID business account, you will have to create one first.

Other payment options

Online banking

Please note the following items from your invoice; they are required for online payment:

- Payee: when setting up the payee on your online banking, choose payee CALGARY (CITY OF) - CORPORATE INVOICE. Please note that different banks may have a different variation of the spelling, e.g. Calgary (City): Corporate Invoice. If you are not sure that you selected the correct payee, confirm with the bank.

- Payee account number: some banks or institutions may refer to this as the accounts receivable number (A/R#). Use your customer number on the invoice. If you are unable to find your customer number, contact the Planning Services Centre.

In person

Planning Services Centre

Third floor, Municipal Building

800 Macleod Tr S.E. Calgary, Alberta

Over the phone

To renew your licence over the phone, please call (403) 268-5311. Please note, we only accept credit card as a payment method over the phone.

Mail - please include Business ID

The City of Calgary

Licence Division

PO Box 2100 Station M (#8043)

Calgary, AB T2P 2M5

Home Occupation Class 2 renewals

To renew your Home Occupation Class 2, sign into your myID business account and manage your business online at apply.calgary.ca. If you do not have a myID business account, you will have to create one first.

Business licence fees

When setting up a new licence, applicable fees apply. Fees are based on the licence type and whether the business is home-based or commercial-based. Business licence fees are non-refundable and non-transferable. Fees are subject to change the next calendar year.

What happens if you don’t renew your licence?

If a licence is not renewed, it will expire. When a licence expires, it cannot be reinstated, and full fees will be charged to apply for a new licence and you will need to obtain all new licence approvals.

Make changes to your business

Business licences are specific to the owner when the business was applied and are non-transferable from one person or entity to another.

You can make some changes to your business, including:

- Moving your Business

- Change your mailing address

- Changing your Trade Name

- Updating your Ownership (sole proprietor or partnership to corporation) * conditions apply

See manage your business for more information.

Business Improvement Area (BIA) and Assessment

A Business Improvement Area (BIA) is established by businesses in an area to jointly raise and administer funds for various projects and promotional activities within the zone throughout the year. Businesses located in a BIA will receive a BIA tax bill. This levy is collected by The City of Calgary on behalf of the BIA.

Planning Services Centre

Hours:

Monday - Friday

8 a.m. - 4 p.m. (MT)

Live chat:

calgary.ca/livechat

Call:

403-268-5311

In person:

Planning Services Centre,

3rd floor, Municipal building

800 Macleod Trail SE

Book an eAppointment for in person services at appointment.calgary.ca

Please note: The Property Research Counter will be temporarily closed from

8:00 - 9 a.m. (MT) on the first Tuesday of each month.