Financial facts

Investing in what matters most to Calgarians

We use your feedback to help create our Business plans and budgets. These plans guide how we deliver City services. Each year, Council can update them to support what Calgarians need and to help keep Calgary one of the most livable cities in North America and the world.

Where do your property tax dollars go?

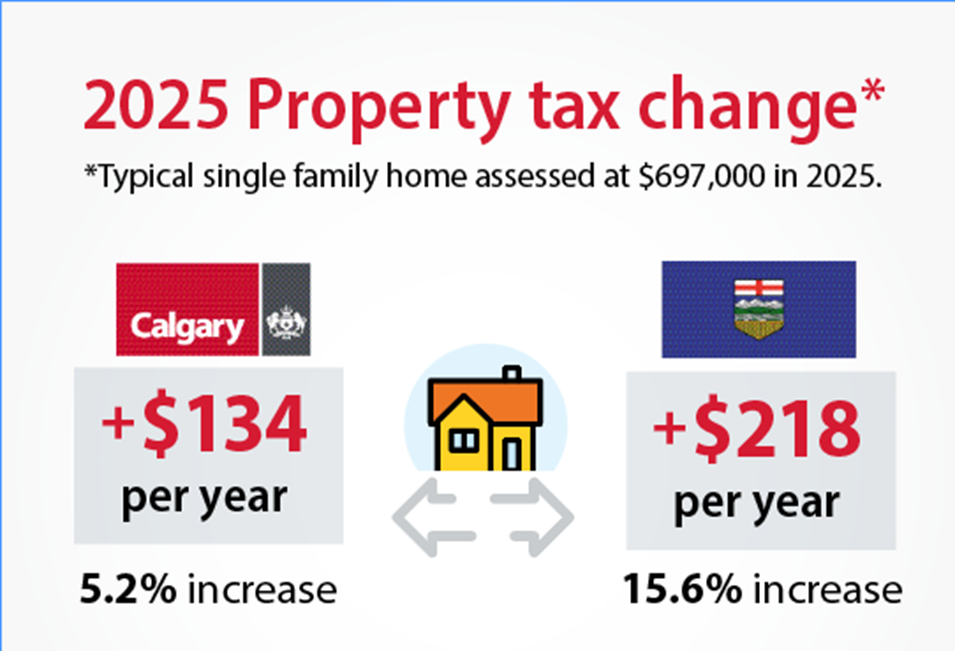

More than one-third of your property tax goes to the province, over $1 billion was sent in 2025. The remaining goes to support 90+ City service like Police, Fire and Transit. Property taxes fund half the cost of our services, the rest comes from other sources like user fees, permits and licenses.

How does Calgary's property tax compare to other cities?

Calgary continues to be one of the most affordable cities for property tax when comparing household income, single-family homes and increases over the last five years.

Popular tax questions

-

What are the annual factors (and timeline) that determine my property tax bill?

-

How does a change in my property’s assessment value (mailed in January) impact my tax bill?

-

Can I get an estimate of my property tax bill (before May), and how is my money used?

-

I pay my bill monthly. Why did my TIPP instalment amount change?