Financial facts

Investing in what matters most to Calgarians

We use your feedback to help create our Service Plans and Budgets. These plans guide how we deliver City services. Each year, Council can update them to support what Calgarians need and to help keep Calgary one of the most livable cities in North America and the world.

Where do your property tax dollars go?

More than one-third of your property tax goes to the Province. The rest helps pay for services like Fire, Police, and Transit. Property taxes make up less than half of our operating budget. The rest comes from other sources like user fees, permits, and licenses.

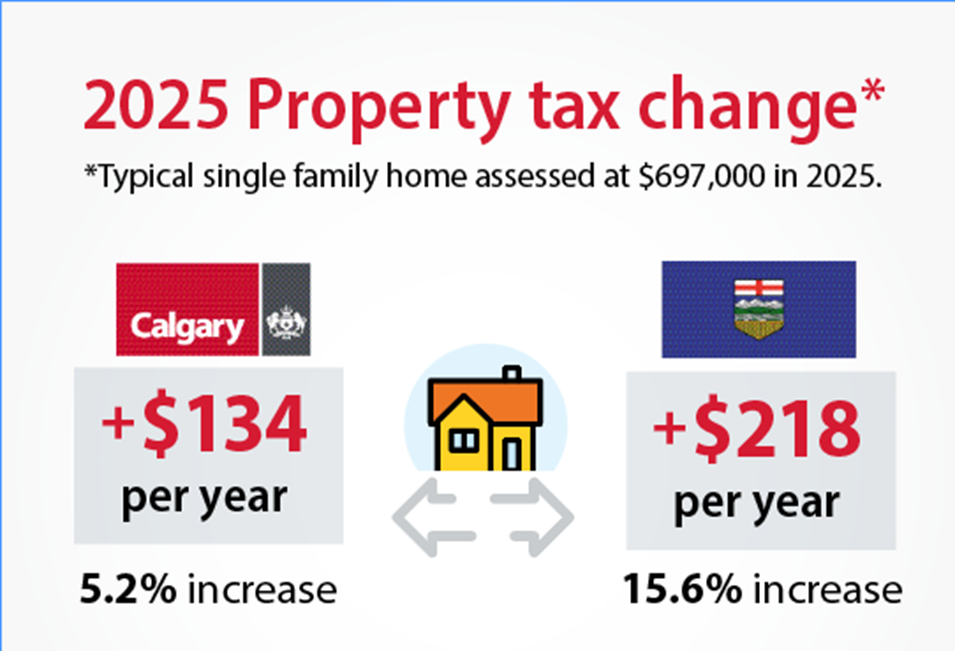

Property tax affordability

Calgary remains one of the most affordable cities in Canada for property tax when comparing the median single residential property. While Calgary’s taxes are similar to nearby cities and towns, we offer more services in comparison. Over the past five years, we’ve had the smallest average property tax increase compared to other major cities. Today, rapid population and inflation growth have outpaced City forecasts, placing pressure on our service delivery.

Popular tax questions

-

What are the annual factors (and timeline) that determine my property tax bill?

-

How does a change in my property’s assessment value (mailed in January) impact my tax bill?

-

Can I get an estimate of my property tax bill (before May), and how is my money used?

-

I pay my bill monthly. Why did my TIPP instalment amount change?