Test page growth

-

Industrial Growth Strategy and Action Plan.

-

What makes Calgary a strong industrial area?

-

Review the quantitative and qualitative analysis of the industrial lands and sector in Calgary.

-

Get additional resources to guide you to success.

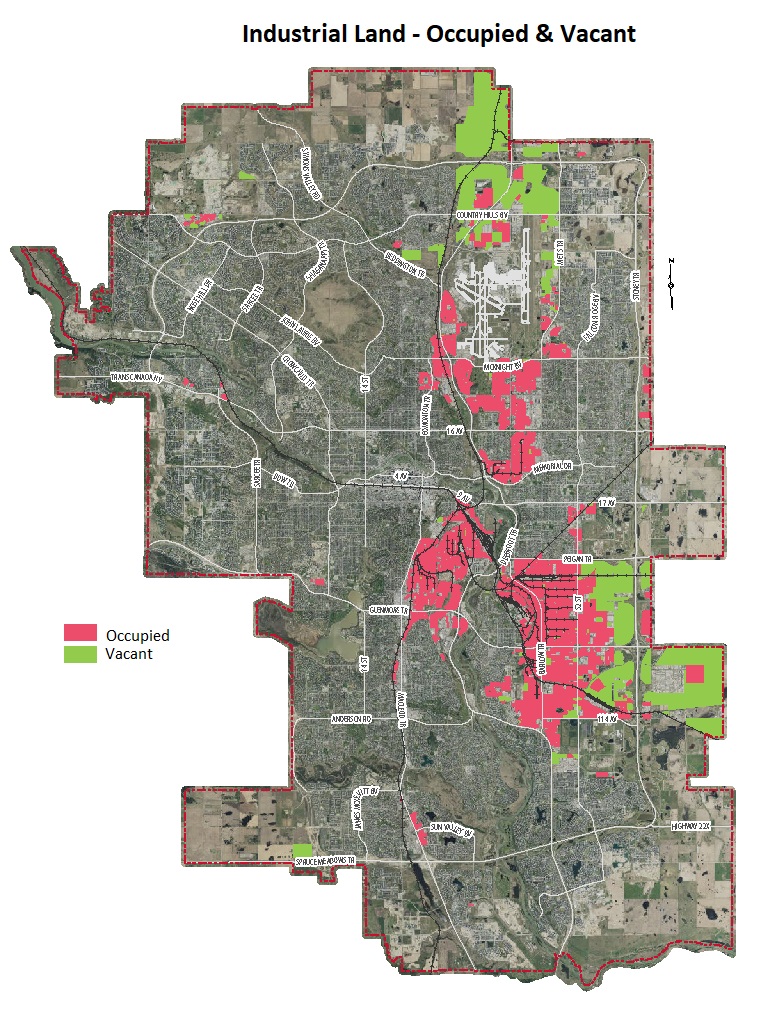

Industrial Land Map

This interactive map illustrates the citywide occupied and vacant industrial lands, the distribution of vacant industrial lands by geography, by land use district (zoning), by ownership, and by servicing status.

Explore the map nowProject Updates

As part of the ongoing work to support the industrial sector in Calgary, we’re excited to share an update about the creation of a Direct Control District (DC) as a pilot project in support of new industrial land development. This pilot opportunity provides more flexibility and certainty to landowners, tenants, and developers and responds to current industrial land use planning challenges.

The City worked closely with BILD Calgary, NAIOP Calgary and other industrial stakeholders to develop the new DC, which is a combination of three existing industrial districts (Industrial General (I-G), Industrial Business (I-C), and Industrial Commercial (I-C). The DC provides a variety of permitted uses to expedite the approval process by reducing/eliminating the need for change of use permits and land use redesignations. It can be used on vacant industrial parcels in the industrial areas, and those adjacent to Major Streets such as Arterial Streets and Industrial Arterial Streets. Parcels in established or occupied industrial areas (such as Greenview or Manchester) do not qualify for this DC.

If you are interested in learning more about the pilot DC opportunity and the advantages for your industrial development, please contact Abdul Jaffari.

Project documents

For more information contact:

Abdul Jaffari

Sr Growth Mgmt Planner

Growth Strategies

Planning & Development

(403) 268-8976

Report Timeline

Old content below

Strong industrial areas are the foundation for Calgary's role as an inland port and distribution centre for western Canada. The growth strategy work for industrial areas will further strengthen that foundation and support diversifying our city’s economic growth.

Project Updates

Citywide Growth Strategy

Comprehensive Citywide Growth Strategy - Working Map

Timeline

- July 26, 2022: Citywide Growth Strategy in the 2023-2026 Service Plans and Budgets Cycle (IP2022-0545) at Combined Council meeting.

- June 27, 2022: Citywide Growth Strategy in the 2023-2026 Service Plans and Budgets Cycle (IP2022-0545) at Infrastructure and Planning Committee.

- February 15, 2022: The 2022 Industrial Action Plan was approved by Council (Item 7.11).

- February 3, 2022: Citywide Growth Strategy: Industrial Action Plan Update (IP2022-0080) at Infrastructure and Planning Committee (Item 7.3).

- March 22, 2021: Citywide Growth Strategy: Industrial report to Council.

- March 3, 2021: Project Scoping Report to the Standing Policy Committee on Planning and Urban Development (PUD) (PUD2021-0150).

- November 2, 2020: The 2020 Review and Update of the Municipal Development Plan (MDP) and Calgary Transportation Plan (CTP) PUD2020-1106, Attachment 4 (Item 8.2.1) identified the need for The Strategy to further implement the MDP and CTP “Scope and undertake a Citywide Growth Strategy: Industrial and based on the recommendations of this work, make necessary amendments to the respective policies in the Industrial Typology sections of the MDP”.

- November 18, 2019: Council provided clarity on the process for The Strategy through the 2019 Growth Monitoring Report PFC2019-1062 (Item 7.12, recommendation #8.d).

- January 13, 2016: The Strategy was initially contemplated as part of the Industry/City Work Plan (PUD2016-0406, Attachment 1).

Project documents

Partnership with industry

As a land developer in the industrial sector, The City of Calgary’s Real Estate & Development Services has a strategy for City-owned industrial lands, however a comprehensive strategy does not yet exist that advocates for growth investments, regulation improvements, and obstacle reduction, regardless of ownership.

Calgary Economic Development’s (CED) Calgary in the New Economy Strategy has four key pillars: Talent, Innovation, Place, and Business Environment. This Strategy has identified actions that help advance Place and Business Environment.

In 2016, as part of the Industry/City Work Plan, a multi-stakeholder Industrial Strategy Working Group was established in support of the industrial sector. This group will continue to inform the delivery of the Strategy and the Action Plan as they progress.

This is a diverse group of internal and external stakeholders, comprised of members from land development associations (BILD & NAIOP), industrial landowners and developers, Calgary Economic Development (CED), professional consultants, industrial brokers, Calgary Airport Authority, and cross departmental Administration.

Calgary’s Industrial lands at a glance

The City retained Cushman & Wakefield to conduct a quantitative and qualitative analysis of the industrial lands and sector in Calgary. The report findings are summarized below. You can also view the full Industrial Area Growth Strategy Consulting Report.

Note: Some numbers have been expressed in imperial measures (square feet, dollars per square foot etc.). This is because commercial real estate data is typically tracked in imperial units.

Competitive Advantages

Calgary has a number of competitive advantages that can be leveraged to help expand existing industrial subsectors, as well as attract and support new industrial development. These advantages include:

- Its strategic location as a distribution centre, and its multimodal logistics network of air, rail, and highways;

- A large and growing labour force;

- High quality services and utilities, including transit, water and power networks;

- Availability of vacant serviced industrial lands in multiple locations, with a range of parcel sizes and land use options; and

- A network of established and existing industrial businesses that can serve as a suppliers and buyers of goods and services to new industrial businesses.

Industrial Land Supply

As of 2020, Calgary had approximately 7,000 hectares of industrial lands. Within this supply about 58% or 4,000 hectares are existing, developed and occupied, while the remaining 42% or 3,000 hectares are vacant and undeveloped. Parts of these vacant lands are serviced, while other parts are not.

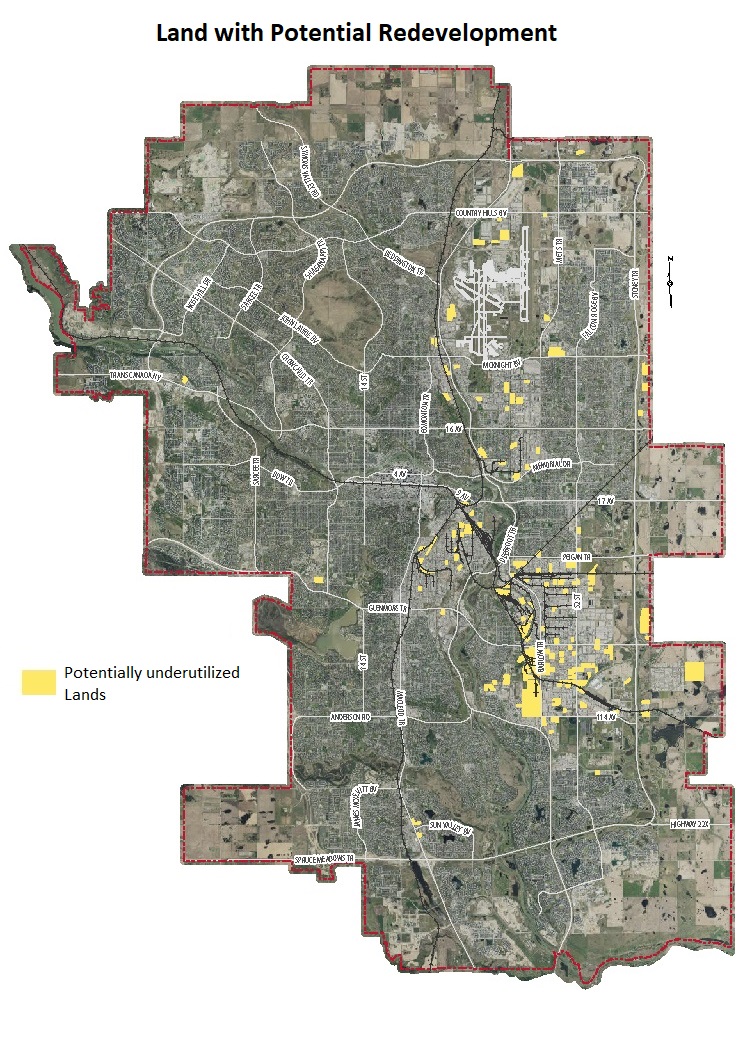

Potentially underutilized lands are defined as parcels that less than 20 per cent parcel coverage.

A vast majority of the industrial lands are located east of Deerfoot Trail NE, and are concentrated in Northeast, Central and Southeast sectors. The occupied industrial areas are made up of diverse land uses. Uses found here are predominantly industrial in nature around 84% of the area (3,600 hectares), commercial uses make up 12% or 500 hectares, while the remaining 4% or 180 hectares are made up of other uses.

There are significant development opportunities in existing and centrally located industrial areas. If all the parcels with the development potentials were to intensify up to 40% site coverage, then an additional 3.1 million m² of floor space would be created. This would reduce the requirement for up to 775 hectares of Greenfield lands in the future.

Vacant Industrial Land Supply

The total vacant land supply in Calgary as of 2020, was about 3000 hectares, about 68% of which are privately owned, and the remaining 32% of City-owned. The majority of the vacant industrial land supply is located in the Southeast (1,489 hectares, or 50% share), and the Northeast (1,407 hectares or 47%). The remaining 78 hectares or 3% are distributed in the Southwest, Central and in the Northwest.

More than half of the vacant industrial land supply or 60% are designed as Special-Purpose – Future Urban Development (S-FUD) District, 29% or 874 hectares are designated as industrial district.

Calgary has a range of serviced, partially serviced, and unserviced industrial lands. The majority of vacant land supply is partially serviced, while 30% or 900 hectares are serviced vacant industrial lands. “Serviced” lands refers to lands where municipal services are in place at the property line and are considered to be “shovel-ready”.

Calgary’s vacant industrial land supply is made up of a variety of parcel sizes, ranging from <0.5 hectares to >25 hectares. For reference, a 1 hectare parcel can accommodate a 4,000 m² building at a site coverage of 40%.

| Vacant Industrial Lands by Geography | ||

| Southeast | 1,489 ha | 50% |

| Northeast | 1,407 ha | 47% |

| Other | 78 ha | 3% |

| Total | 2,974 | 100% |

| Vacant Industrial Lands by Land Use Districts | ||

| S-FUD – Future Urban Development | 1,748 ha | 60% |

| Industrial | 874 ha | 29% |

| Industrial – Multiple | 287 ha | 10% |

| Direct Control District | 27 ha | 1% |

| Total | 2,974 ha | 100% |

| Vacant Industrial Lands by Servicing Status | ||

| Serviced | 887 ha | 30% |

| Partially Serviced | 1,315 ha | 44% |

| Unserviced | 771 ha | 26% |

| Total | 2,973 ha | 100 |

| Vacant Industrial Lands by Parcel Size | ||

| <0.5 ha | 12 ha | 21% |

| 0.5 – 1 ha | 52 ha | 27% |

| 1-5 ha | 239 ha | 37% |

| 5-25 ha | 739 ha | 12% |

| >25 ha | 1,932 ha | 3% |

| Total | 2,974 | 100% |

Industrial Building Inventory

As of Q3, 2020, Calgary’s industrial building inventory was nearly 131 million sf. This makes Calgary the fourth largest industrial market in Canada – behind Toronto, Montreal, and Vancouver, just ahead of Edmonton, at 130 million sf.

| Submarket | Building Inventory | |

| Southeast | 60.8 million sf | 47% |

| Northeast | 47.7 million sf | 37% |

| Central | 22.3 million sf | 17 |

| Total | 131 millon sf | 100% |

The Southeast submarket has the largest share of industrial building inventory, as well as industrial vacant land supply. This highlights the importance of the southeast in the industrial sector.

Industrial Vacancy Rate

As of Q3, 2020, there were nearly 10 million sf of vacant industrial space, with a vacancy rate of 7.6%. The lowest vacancy rate was in Central submarket (5.7%), followed by Southeast at 7.3% and Northeast at 8.9%. Historically, the vacancy rate has been the highest in the Northeast, and lowest in the Central Submarket, which highlights the importance of the central industrial areas of the city. For comparison in Q3, 2020, the national industrial vacancy rate was 2.5%.

Absorption

Over the past 10 years, Calgary has averaged just over 2 million sf of positive absorption annually. 2016 was the only year in which negative absorption was recorded (a decline in the amount of occupied space). Despite the challenges of current Covid-19 pandemic, absorption has been positive through the first three quarters of 2020 with approximately 223,000 sf.

New Industrial Building Supply

In the last decade, Calgary has averaged just over 2 million sf of new industrial building supply annually, ranging from as low as 324,000 sf in 2017 to a high of 5.3 million sf in 2019. Approximately 60% all new industrial buildings were built in the Northeast, 40% in the Southeast and 1% in the central sector.

In the first three quarters of 2020, approximately 575,000 sf of new industrial buildings were constructed in Calgary, and additional 2.5 million sf currently under construction.

Industrial Rental Rates in Calgary

In the first quarter of 2020, Calgary’s industrial sector experienced lower rental rates due to COVID-19 pandemic. The Southeast sector experienced the lowest rate during Q1, 2020. However, rental rates across the city rebounded during Q2, and Q3, 2020 to approximately $8.75 net per square feet on average.

Industrial Sector’s Future Growth

Calgary is home to several industrial subsectors. The largest subsectors include warehousing and storage, general freight trucking, and specialized freight tracking, wholesale trade and manufacturing. The top 20 industrial subsectors that are anticipated to account for the largest gains in employment in Calgary by 2041 is listed below.

Top 20 Industrial subsectors by employment increase (2016-2041) – City of Calgary |

|||||

Industrial Subsector |

2016 |

2041 |

|||

*Jobs |

Rank |

Jobs |

Additional Jobs |

Rank |

|

| Warehousing and Storage | 3,830 |

1 |

11,505 |

7,675 |

1 |

General freight trucking |

2,810 |

3 |

7,400 |

4,590 |

2 |

Food merchant wholesalers |

2,615 |

4 |

5,188 |

2,573 |

3 |

Specialized freight trucking |

1,735 |

13 |

3,051 |

1,316 |

4 |

Architectural and Structural metals manufacturing |

1,765 |

11 |

2,963 |

1,198 |

5 |

Other miscellaneous manufacturing |

1,190 |

17 |

2,370 |

1,180 |

6 |

Recyclable material merchants wholesalers |

730 |

27 |

1,846 |

1,116 |

7 |

Bakeries and tortilla manufacturing |

1,490 |

14 |

2,604 |

1,114 |

8 |

Beverage merchant wholesalers |

470 |

37 |

1,245 |

775 |

9 |

Petroleum and petroleum products merchant wholesalers |

2,125 |

6 |

2,759 |

634 |

10 |

Beverage manufacturing |

1,085 |

20 |

1,654 |

569 |

11 |

Glass and glass product manufacturing |

460 |

39 |

916 |

456 |

12 |

Farm product merchant wholesaler |

245 |

67 |

687 |

442 |

13 |

Household and institutional furniture and kitchen cabinet manufacturing |

1,405 |

15 |

1,807 |

402 |

14 |

Aerospace product and parts manufacturing |

405 |

44 |

704 |

299 |

15 |

Other food manufacturing |

465 |

38 |

726 |

261 |

16 |

Meat product manufacturing |

1,170 |

18 |

1,414 |

244 |

17 |

Basic chemical manufacturing |

845 |

25 |

1,081 |

236 |

18 |

Navigational, measuring, medical and control instruments manufacturing |

1,125 |

19 |

1,358 |

233 |

19 |

Industrial machinery manufacturing |

190 |

70 |

374 |

184 |

20 |

*Industrial Area Growth Strategy Consulting Report,, Cushman & Wakefield

Calgary's Transportation Network and other advantages

People and Technology

Calgary has long been known as an oil and gas town but the city is diversifying and investing to support a thriving technology and innovation sector. According to research by Calgary Economic Development, Calgary is among the top five competitive tech talent markets in Canada, and boasts the country’s highest concentration of entrepreneurs and start-up companies per capita. It is home to six post-secondary institutions (University of Calgary, Mount Royal University, Southern Alberta Institute of Technology (SAIT), Alberta College of Art & Design (ACAD), Bow Valley College and St. Mary’s University) that offer programs in technology, clean energy, manufacturing and other areas to align with market needs.

Investment has also been made to ensure the city’s highly efficient supply chain network is strengthened. Calgary’s investments in dark fiber optic communication networks have resulted in next-generation speed and enhanced service delivery in a digital economy. Connectivity is required in every sector – from energy, finance, real estate, transportation and logistics to manufacturing – ensuring that businesses are connected with fibre optic cable is a key competitive differentiator.

Transportation and the Inland Port

Calgary is truly a connected city. By air, rail or road, Calgary is a city that moves. It is central to the regional inland port for Western Canada and is integral to a distribution-driven industrial goods movement market that is diverse and resilient. The city’s geography, access to the national TransCanada highway systems and CanaMex corridor allows businesses to get goods to market and reach 16 million consumers in Western Canada and the Pacific Northwest by road in one day. The Calgary International Airport further facilitates the movement of goods and people, and transports 75% of the province’s air cargo shipments.

Calgary’s transportation and distribution sectors are a catalyst for many other industries including warehousing and logistics, autonomous vehicle testing, drone manufacturing, robotics, and others.

Calgary’s advantages of competitively priced industrial lands and critical infrastructure that supports connectivity and access to customers distinguish Calgary and the businesses that locate here.

Land Use Policies and Regulations

There are several guiding land use policies and regulations that regulates and enables the industrial sector.

Municipal Development Plan

Calgary’s Municipal Development Plan is our vision for how Calgary grows and develops over the next 60 years. Calgary is expected to grow to two million people over that time, so it is important to plan for our future. It works together with the Calgary Transportation Plan and strives to create an environment where The City can provide services that Calgarians desire in a way that is financially sustainable while protecting our natural environment and supporting a prosperous economy.

Supporting MDP policies for the industrial sector are:

- Attract and retain business and industry in Calgary by fostering economic diversification and providing a climate that competitively attracts and enhances economic activity (sec 2.1.2 a).

- Protect the integrity of viable employment and retail areas by supporting the retention and growth of existing businesses (Sec 2.1.2 b).

- Identify railroad inter-modal sites as strategic destinations within the regional logistics network and plan for supporting land uses that benefit from proximity to these facilities (Sec 2.1.2 l).

- Recognize the access needs of the logistics industry by locating warehouses and local distribution centres in areas that provide direct roadway connections to the goods movement corridors (Sec 2.1.2 m).

- Ensure the availability of competitively prices, easily serviceable and developable land for industrial purposes; including providing opportunities for brownfield redevelopment (Sec 2.1.2 n)

- Protect appropriately located industrial areas from undue encroachment by residential development in case where the nature of that industrial activity requires separation from residential uses (Sec 2.1.2 o)

- Industrial uses should be maintained as the primary uses (Sec 3.7.1 a)

The Guidebook for Great Communities

The Guide for Local Area Planning is one of many tools in our planning system that work together to create great communities for everyone. One of the principles for Great Communities is Economic Vitality “Everyone has access to diverse employment options and lives in a city that supports starting, operating and sustaining a business”.

The Guidebook help local area plans implement and refine the growth policies of the Municipal Development Plan by providing urban form categories that builds upon city-wide typologies. There are three Urban Form Categories in the Guidebook:

- Industrial General

- Industrial Heavy

- Industrial Transition

The Guidebook provides additional policies for the industrial sector.

Industrial Area Structure Plans (Local Area Plans)

There are five Industrial Area Structure Plans (ASP) that refine and implement The City's broader planning objectives contained in the MDP and CTP. These plans help to shape the physical environment with the goal to achieve a pattern of orderly, economical, compatible development in support of successful business and industrial sector growth. The industrial ASPs are for the Northeast, Nose Creek, Shepard, Southeast 68 Street, Southeast and Stoney areas. For more information see the Community and Area Plans section of the Planning and Development Resource Library.

Land Use Bylaw

The Land Use Bylaw outlines the rules and regulations for development in Calgary as well as the process of making decisions for development permit applications. Part 8 of this document contains the eight (8) industrial districts (zones) that regulates industrial development. Efforts are underway to simplify these regulations.

FAQ

What is the purpose of the Strategy?

The purpose of the Strategy is to increase Calgary’s economic and business competitiveness and enable the development of Calgary’s industrial lands.

Over the past few years, there has been a number of initiatives in support of industrial sector. The Citywide Growth Strategy: Industrial (Strategy) provides an Action Plan that centralizes existing efforts, and identifies additional actions in support of the industrial sector.

In collaboration with the stakeholders, The City can help the industrial sector through five categories of actions:

- Development enabling regulatory improvements: Actions that streamline regulations and update guiding policy

- Public realm, infrastructure, and servicing investment: Actions that use public investment in supporting infrastructure to enable growth.

- Cost: Actions to reduce development costs and charges

- Public Lands: Actions in which The City’s role as a land developer can support elements of market activity.

- Business Environment: Actions that support existing business and encourages new ones.

Why are industrial areas important?

Industrial lands play a crucial role in Calgary’s economic prosperity and contribute approximately 22% of Calgary’s total municipal tax revenue, or around $300 million annually. While representing 8.5% of total land area of the city or approximately 7,000 hectares of land, industrial areas supply many employment opportunities for the citizens of Calgary and region. In 2020, Calgary’s industrial areas supported over 66,000 jobs, accounting for 11% of jobs in the City.

What businesses sectors are located in industrial areas?

Calgary’s industrial areas support a wide variety of industrial activities and accommodate their operational needs. Some of the main industrial subsectors present in Calgary include, warehousing and storage, general freight trucking, food merchant wholesales, beverage manufacturing, meat product manufacturing, basic chemical manufacturing, and industrial machinery manufacturing. These industrial subsectors are projected to grow.

More Information

- Industry/City Work Plan

- Calgary land Use Bylaw

- Calgary Real Estate Blog

- Planning & Development resource library

- City-Owned Land for Sale

Partner Links

For more information contact:

Abdul Jaffari

Sr Growth Mgmt Planner

Growth Strategies

Planning & Development

(403) 268-8976