Properties annexed in 2007

Property owners with land annexed to The City as part of the 2007 Annexation Order OC 333-2007 had their municipal tax rate changed to a City of Calgary rate in 2022. The 15-year taxation clause expired on December 31, 2021. Calgary’s municipal tax rate will be applied to determine your share of property tax based on your property type: residential, non-residential, split-use or farmland.

Note: On Tuesday, April 30, 2024, Calgary City Council approved a tax relief program for 2024 for residential property owners impacted by the expiry of tax provisions in Annexation Order 333/2007. Learn how this may impact your 2024 property tax bill.

-

Learn more about annexation, a provincially-legislated process governed by the Municipal Government Act that transfers land from one municipality to another to accommodate growth.

Your property assessment and review periods

Your property’s assessment is one factor that determines your share of property tax.

The City has been preparing property assessments for your property since 2007 as part of this Annexation Order. Your assessment reflects the market value of your property as of July 1.

Residential, split-use and farmland property owners

Quick Links

- Join TIPP. Visit Tax Instalment Payment Plan (TIPP)

- Need help with your taxes. Visit Alberta Seniors Property Tax Deferral Program

Fair Entry - Property Tax Assistance Program

Get an estimate of your property tax bill before May 2024

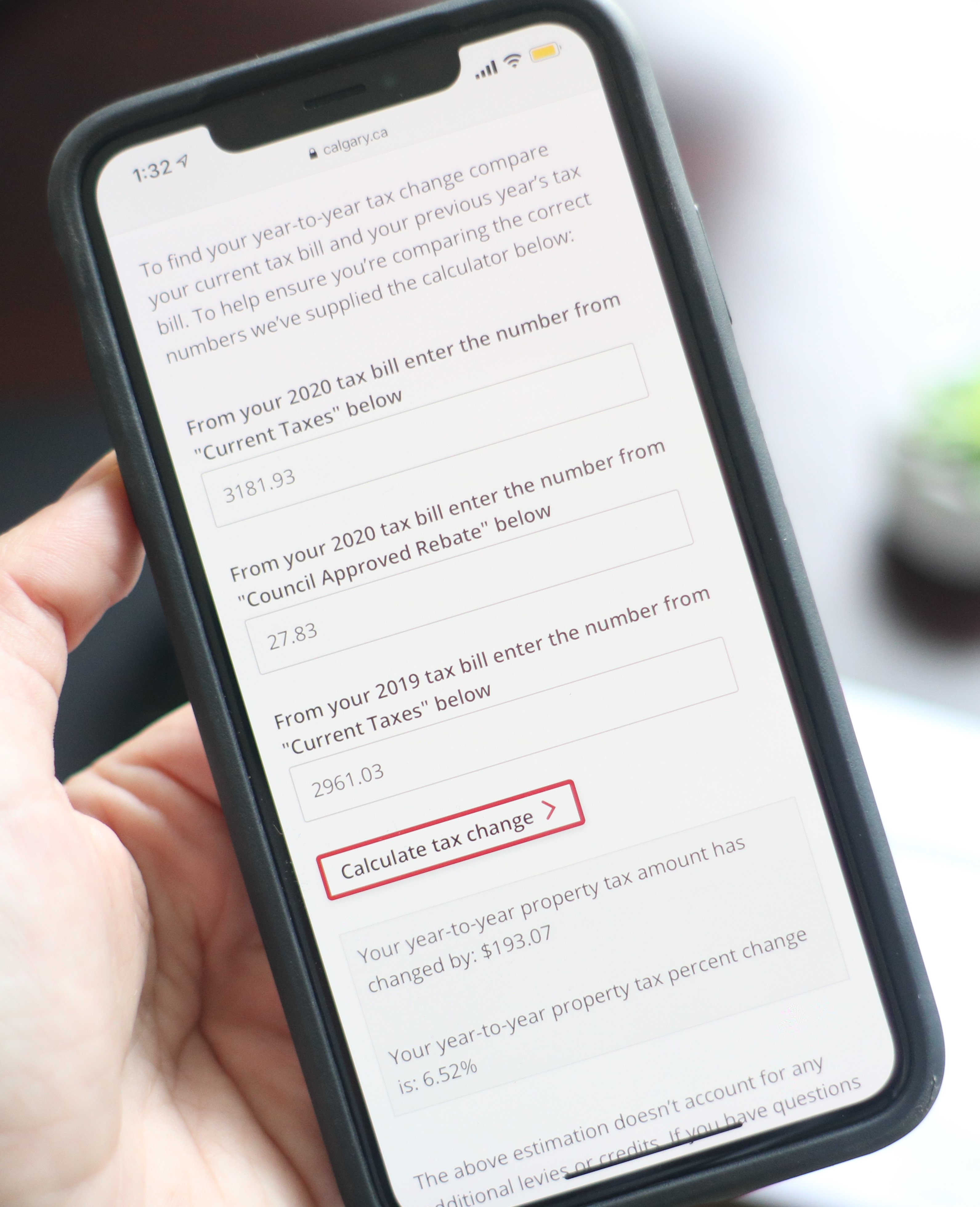

You can obtain an initial estimate of your 2024 property tax bill using your 2024 property assessment notice.

Visit calgary.ca/taxcalculator to learn more and see how your property tax dollars are invested in City services.

How can I request or inquire about other City services not related to my property's assessment?

Please contact 311 to discuss any additional City service inquiries you might have that are not related to your property's assessment.

The City provides services and programs to annexed properties that are logistically and financially feasible. Each location is unique, and some services might be provided while others require further urban development.

Contact 311Historical background

The annexation negotiation process between The City of Calgary and the Municipal District of Rocky View began in October 2002. A series of initial open house events were held in November 2002 for landowners and the general public.

In September 2005, formal mediation began between The City of Calgary and the MD of Rocky View. The City of Calgary presented a new annexation proposal as part of the process. This proposal and proposed maps for annexation were presented at a series of four open house events with the public in November 2005. Representatives of both The City of Calgary and the MD of Rocky View were on hand to make presentations and answer questions from those in attendance.

The joint annexation mediation committee held 37 meetings September 2005 - October 2006. On October 16, 2006, City Council authorized Administration to finalize the annexation agreement and apply for annexation to the Municipal Government Board (MGB).

As a result of the ongoing mediation along with information and feedback received from citizens, both Councils (MD of Rocky View and The City of Calgary) considered a new proposed agreement in their respective meetings on Monday, June 12, 2006. The MD of Rocky View Council approved the annexation agreement on November 7, 2006. The annexation agreement was signed by the Mayor and the Reeve on November 24, 2006 and the Annexation Application was submitted.

The MGB held a week of hearings beginning on March 26, 2007. The MGB reviewed the application and presented its report to the Minister of Municipal Affairs & Housing. The Minister further reviewed the report, and then took it to Cabinet for its decision, resulting in the approval of the annexation agreement, as recommended by the Municipal Government Board.

Questions & answers

What is Annexation?

Annexation is a provincially-legislated process governed under Municipal Government Act. Lands are transferred from one municipality to another to accommodate future urban growth and development. The new municipality provides services and their regulatory authority to protect public health and safety.

How is land annexed in Alberta?

In Alberta, annexations are regulated by the Land and Property Rights Tribunal (formerly Municipal Government Board). The annexation process involves negotiations between local governments, public engagement with property owners, a formal review by the Land and Property Rights Tribunal and the Minister of Municipal Affairs. The Minister of Municipal Affairs brings forward the annexation orders to Cabinet. If approved or approved in part, the Lieutenant Governor of Alberta signs the order. Further details about the annexation process can be found on the Land and Property Rights Tribunal website.

Why did The City annex these properties?

The 2007 annexation helped ensure key elements of The City’s long-term growth requirements, strategic interests and future opportunities were achieved, including:

- Safeguarding The City’s ability to accommodate its significant rate of growth

- Maintain and expand a variety of growth directions to promote competition in the residential marketplace, provide a measure of housing affordability, and provide more certainty to maintain The City’s historic growth management approach.

- The 2007 annexation secured an additional 14 years of residential land supply and 12 years of industrial land supply, which at that time ensured Calgary had 30 plus years of developable land.

- Developing a relatively compact, contiguous, efficient, and cost-effective urban form that mitigates sprawl and benefits the Calgary region.

- Promoting fiscal fairness and equity in the Calgary region through an approach to governance whereby all urban development remains under one municipal jurisdiction.

- Protecting key environmental and watershed corridors (later creation of Ralph Klein Park).

Calgary annexed approximately 103 square kilometres / 25,000 acres of land from Rocky View County. Annexation remains one of the primary means by which our city has grown, see the History of Annexation Map for an overview of Calgary’s growth.

What value does annexation bring Calgary and landowners?

Creating urbanized areas enhance major services, including the planning of transportation and utilities services, uses resources more efficiently, captures growth, gains a tax base and helps with regionalization. Landowners receive enhanced and additional services and programs not typically offered by rural municipalities.

Does annexation mean immediate development?

Annexation of land does not mean immediate development or urbanization. Development and urbanization are a product of inputs such as planning, servicing and market demand. The City has a well-developed process to realize development in locations that are or can be serviced with high-quality urban infrastructure such as transportation, safety, and utilities.

As development and urbanization takes place, residents and businesses are further exposed to a wide range of services not offered by rural municipalities.

Municipal property taxes enable The City to deliver services such as Police, Fire & Emergency Response, and roads, but it also helps pay for other things, including social programs, and recreation facilities.

User fees services, such as water, wastewater, and waste & recycling, are provided as lands are further developed or where services can be provided logistically while remaining fiscally responsible.

How does Calgary plan for future growth and development?

The Municipal Development Plan (MDP) and Calgary Transportation Plan (CTP) are The City’s long-range land use and transportation plans that look 60 years into the future. The Plans help shape how the communities we live and work in grow, develop and evolve over time. The MDP and CTP were updated in 2020 as our city continues to change and grow.

The City has also begun a process to consult with local community members and businesses to plan for future development at the community level through the Local Area Planning process. The City currently has over 200 policy documents that guide local area development and redevelopment within the city. The Local Area Plan process anticipates revisiting those 200 policy documents and implements approximately 42 local area plans, which will direct where and how we develop the city within its current boundaries. This process is anticipated to be approximately a ten-year-long process and will generally begin in areas within the inner-city and work outwards towards the municipal boundaries. Our long-range plans make sure City staff, communities, developers, business owners, citizens and Council are working together to build a great city. Learn more about Planning for Calgary’s future.

Why is the municipal tax rate for properties annexed in 2007 now changing in 2022?

The taxation clause under the Annexation Order 333/2007 (MD of Rocky View to The City of Calgary) provided properties a Rocky View County tax rate for 15 years, which expired on December 31, 2021. After this date, The City of Calgary municipal property tax rates will be applied to the annexed properties identified.

Why were the Rocky View Municipality tax rates maintained for the past 15 years, and were landowners consulted?

Per the LAND AND PROPERTY RIGHTS TRIBUNAL (alberta.ca) procedures, The City negotiated with Rocky View County regarding the lands proposed to be annexed in 2007. This included consulting with landowners on the future assessment and taxation of annexed lands. The assessment and taxation scheme is legislated to ensure fairness in the taxation of property. The City and Rocky View County explored various options with landowners to mitigate the financial and potential tax impacts of annexation. This included maintaining the Rocky View County tax rate for 15 years, which was later added to the conditions of the annexation and confirmed by the Lieutenant Governor in Council in 2007.

How does The City put municipal property tax dollars to good use?

Municipal property taxes are the primary way The City delivers services and programs that Calgarians need and value every day. We provide a wide range of City services not offered by rural communities. The City is working to educate Calgarians on how these dollars are calculated, collected, and used to provide City services. Delivering value through our City services and programs requires proper planning throughout the year.

City tax-supported services

- Police Services: Crime prevention and education, law enforcement and criminal investigations to make Calgary a safer place.

- Fire & Emergency Response: Responds to fires, emergencies, accidents, hazards & specialized rescues

- Public Transit: Safe, effective, reliable and affordable public transportation. Including supporting specialized transit.

- Streets: Building & maintaining Calgary streets, & keeping you safe with reliable roads

- Sidewalks & Pathways: Plans, designs, builds & maintains sidewalks & pathways to keep you moving

- Parks & Open Space: Manages Calgary's parks, urban green spaces and natural areas. In addition, cemeteries and urban forestry services.

- Recreation Opportunities: Recreation, sports & leisure & registered programs for a healthy Calgary

- Affordable Housing: Safe and affordable homes for lower-income Calgarians

- Citizen Engagement & Insight: Safe, fair & accessible feedback & participation in our government

- Social Programs: Services in communities to support, protect and enrich Calgarians' lives

Review all tax-supported and user-fee City services and programs at calgary.ca/services. Learn more on calgary.ca/ourfinances.

Is Calgary’s residential property tax competitive with other major municipalities in Canada?

In 2020, Calgary had below-average residential property taxes relative to a cross-section of major Canadian cities and regional neighbours for a representative two-storey house.

The City measures its performance relative to other Canadian cities and uses this information to help identify where we are doing well and where we can improve. We also monitor how we compare against international cities based on various world ranking studies throughout the year.

How are annexation properties valued?

Properties are valued based on the provisions of specific annexation orders. For the 2007 annexation order No.333/2007 (MD of Rocky View to The City of Calgary), The City has been preparing property assessments for these annexed properties since 2007 to help determine their share of property taxes. Assessments reflect the market value for properties as of July 1st, and the characteristics and physical condition of the properties as of Dec 31st of the year prior.

Property owners can visit calgary.ca/assessment to learn about the assessment process or contact assessment during the Customer Review Period which runs from January 5 through March 14, 2022 should they have questions about their assessment.

Do these properties currently receive a City of Calgary property tax bill?

Yes, per the 2007 annexation order No.333/2007 (MD of Rocky View to The City of Calgary), The City has been preparing property tax bills for these properties using the Rocky View County tax rate. These bills are identical to what other city of Calgary properties receive each May. In 2022, these properties will receive the same property tax bill, but with the 2022 City of Calgary property tax rate approved by Council and reflective of their property type.

Have these properties been benefiting from City services and programs since 2007?

The City provides services and programs to annexed properties where logistically and financially feasible. Each location is unique, and thus some services or programs might be made available while others are not. For example, Water Services are not paid for by property taxes, but rather are 100 per cent funded from the rates paid by customers. Typically, Water Services come online in new areas once significant development has occurred and there is the necessary funding to pay for the needed capital investments in water and wastewater infrastructure. At present, The City’s water, wastewater or stormwater services have not been extended to all areas as there isn’t sufficient funding.

Property owners are encouraged to contact 311 to connect with the appropriate business unit to discuss any specific service request or program.

Who can property owners contact about a City service or program?

Property owners can contact 311 for questions about City services or programs. 311 will create a Service Request and route the inquiry to the most appropriate business unit to address the property owners’ questions or concerns.

How has The City created awareness with these property owners?

The City contacted impacted property owners with direct mail in 2021 October, in addition to using social media, web and 311 channels to create awareness of the tax rate change and benefits of City services and programs.

Does The City offer any programs to assist residential property owners in need?

Residential property owner experiencing financial hardship, regardless of age, may be eligible for a credit/grant of the increase on your property tax account. To learn more about the eligibility of this program, please visit Property Tax Assistance Program (calgary.ca).